When it comes to financial decisions, sometimes it’s best to get back to basics. Whether you are looking to improve your credit score or your financial literacy , there are many positive steps you can take to build your net worth .

Up Next: 5 Actions to Take Once Your Savings Hit $50,000

For You: 5 Actions to Take Once Your Savings Hit $50,000

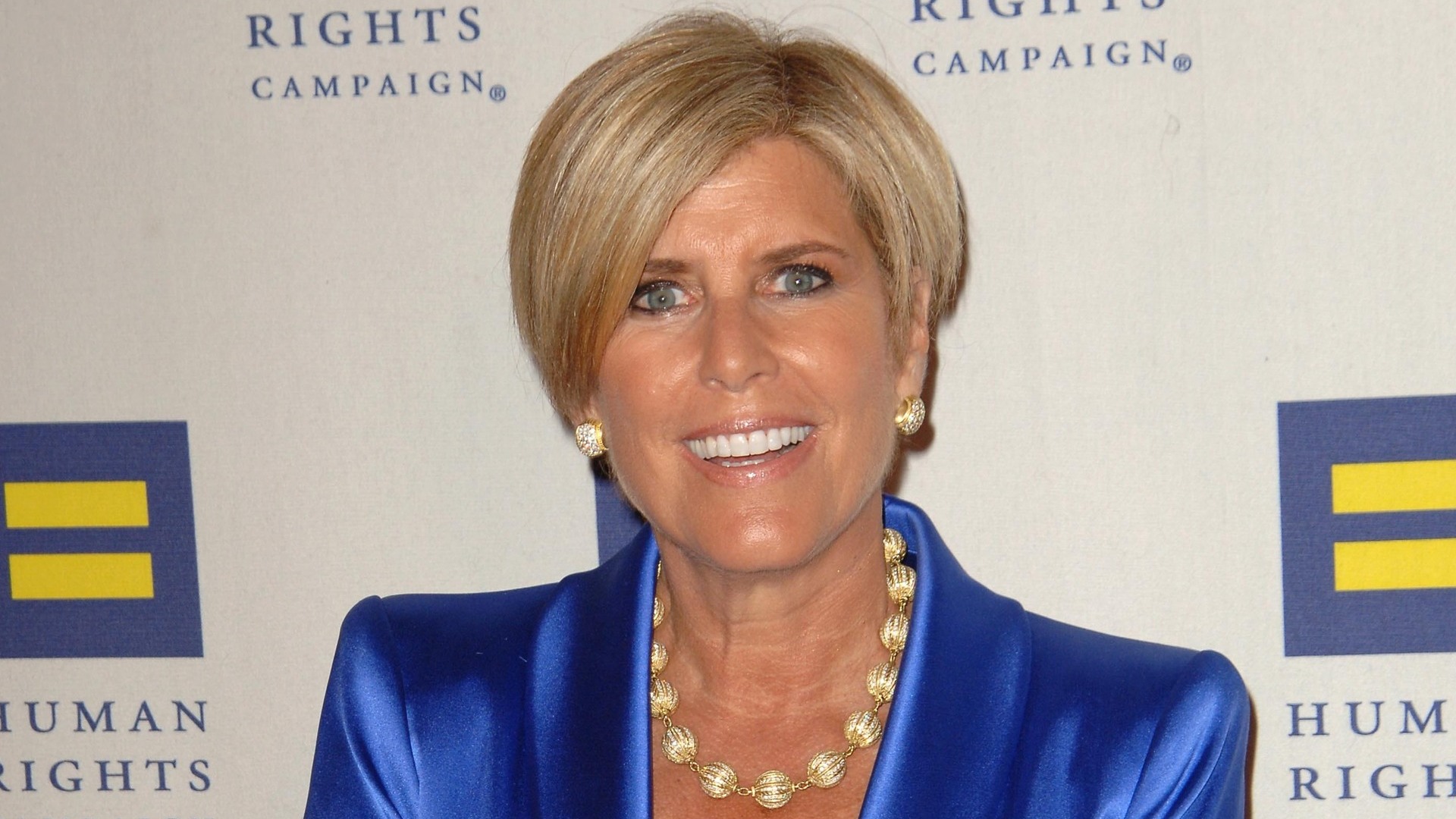

Financial expert and bestselling author Suze Orman is known for her easy-to-follow, no-nonsense money advice This can assist individuals in achieving financial independence. She famously stated, "True power in life isn’t attained unless you have mastery over your finances."

Orman suggests multiple actions one can undertake to gain mastery over personal finances. There isn’t an ideal moment to begin; initiating this process at any point is beneficial. Her guidance is highly appreciated due to its straightforward nature. This clarity aids individuals in adhering to her recommendations and achieving monetary objectives within a feasible timeframe.

Here are a few of hers top fundamental financial guidelines to kick things off .

Making passive income does not have to be complicated. You can begin this week.

Regulation 1: Address Your Credit Card Debts

Orman frequently speaks about living within your means. One way to do that is to tackle your credit card debt. She recommends that individuals call their credit card issuer and ask for the interest rate to be lowered.

She notes that the average interest rate on credit cards is around 22%, which is high. So, a good money rule of thumb is asking for a reduction to help save you substantial amounts of money each month.

She also recommends checking if you're eligible for a "balance transfer offer." Sometimes, you could get access to a zero-percent interest rate for between 12 to 18 months. During this timeframe, you have the opportunity to focus on paying down your debt without being concerned about accruing interest charges.

Read More: Suze Orman Claims That Making This Move Is "The Greatest Error in Life"

Regulation 2: Create an Emergency Fund

Another aspect that Orman frequently suggests is to have a healthy emergency fund She frequently suggests that you strive "to build an emergency savings fund capable of covering as much as one year’s worth of living expenses."

A contingency fund can assist you in weathering any financial difficulties that may arise.

Guideline 3: Develop an Action Plan

Orman strongly advocates for developing a comprehensive financial strategy, like her 5-Step Financial Action Plan featured on Oprah.com. She recommends that people prioritize paying down their credit card debts and boosting their FICO scores prior to formulating plans for spending, saving, and retiring.

Your expenditure strategy starts by dividing all your costs into necessities and desires. Following this, you pinpoint all the discretionary items. Afterward, you cut out these non-essential expenses if you lack adequate savings or are burdened with significant debts.

Regulation 4: automate your savings

Orman also routinely recommends you automate your savings. Her reasoning behind automation is it “is a proven way to stay committed to a savings goal.”

She notes that it doesn’t necessarily matter how much you are moving over, as long as you are moving it over consistently. She said, “Having money zapped from your checking account into your savings accounts is free, too. The ‘set it and forget it’ approach is how you will reach your savings goals.”

If you're seeking methods to begin managing your finances, consider implementing the 50/30/20 rule—a budget strategy dividing your income into specific portions. Each payday, you might set aside 50% of your earnings toward necessities, 30% towards non-essential items, and direct 20% into a high-interest savings account.

Guideline 5: Establish a Roth Account

Ultimately, Orman recommended that people—especially young adults—should consider opening Roth accounts. She goes as far as suggesting that parents could establish a Roth account for their kids if possible.

When it comes to financial planning outside of property investment, prioritizing contributions to retirement accounts is crucial. Whenever feasible, aim to maximize these deposits.

Caitlyn Moorhead assisted with the research for this piece.

More From INSPIRDIGITAL

- Mark Cuban: Trump's Tariffs Will Hit This Group Hardest

- How Middle-Class Workers Are Secretly Turning Into Millionaires — and How You Can Do It Too

- Utilize This List to Determine If Your Family Is Financially Stable

- 4 Minimal-Risk Strategies To Grow Your Savings in 2025

This article originally appeared on INSPIRDIGITAL : Suze Orman’s 5 Basic Money Rules To Get You Started on the Right Track

No comments:

Post a Comment