- Kenya sought a fresh program from the International Monetary Fund (IMF) following the cancellation of its ninth review.

- The accord between Nairobi and the Bretton Woods institution was inked in April 2021 and was expected to wrap up in April 2025.

- Geopolitical economist Aly-Khan Satchu informed INSPIRATIONS DIGITAL.co.ke that Kenya's departure might initiate a detrimental chain of events, resulting in increased Eurobond yields and a devalued shilling.

Japhet Ruto, who works as an editor for INSPIRATIONS DIGITAL.co.ke, has accumulated more than eight years of experience in fields such as finance, commerce, and tech. He provides insightful observations on financial patterns both within Kenya and internationally.

After the suspension of the ninth review under the International Monetary Fund (IMF) program, President William Ruto’s government failed to receive around KSh 110.04 billion in loans.

Why Kenya terminated its IMF program?

Kenya and the IMF decided to jointly end the programs under the Extended Fund Facility (EFF) and the Extended Credit Facility (ECF).

Nairobi was additionally expected to receive $360.9 million (KSh 46.7 billion) from the Rapid Support Facility for climate-related funds.

Kenya entered into an accord with the Bretton Woods institution in April 2021, which was expected to be completed by April 2025.

The government’s choice, enabling a fresh initiative from an international finance organization, was taken despite fiscal worries like raising revenues, ensuring sustainable debts, and dealing with external borrowing challenges that included various stipulations.

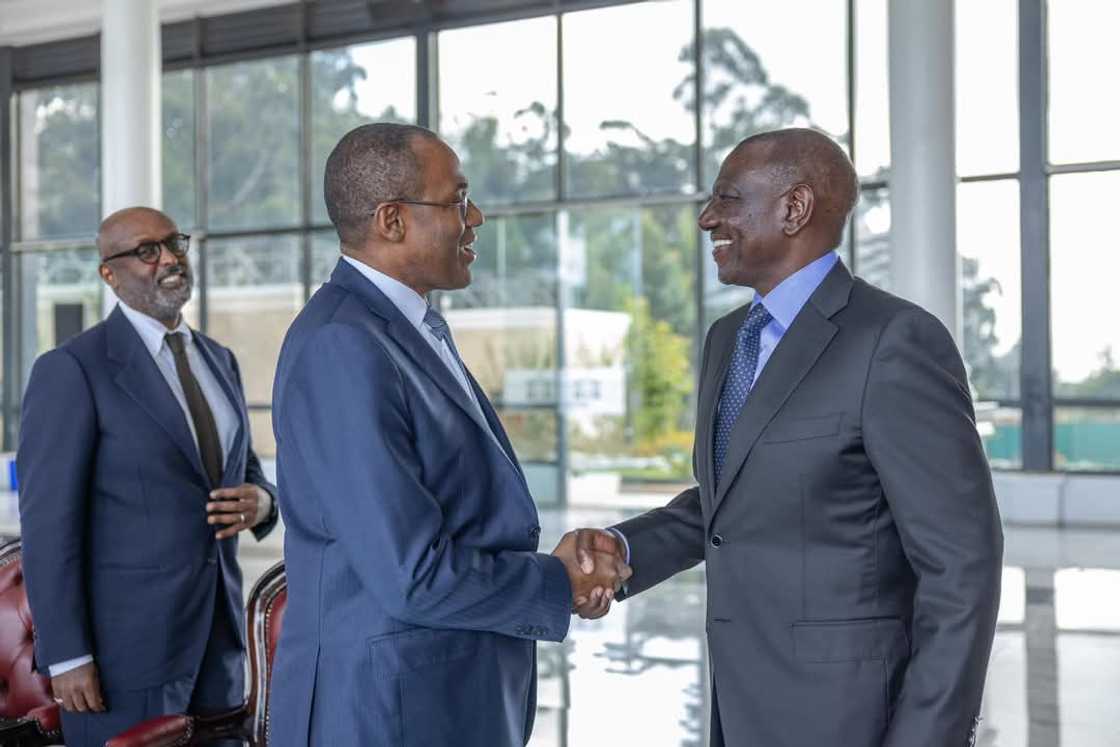

Following the visit of an IMF delegation, headed by Haimanot Teferra, to Nairobi from Thursday, March 6, through Friday, March 14, the decision to cancel was made.

The mission team held discussions with Kenyan officials regarding recent developments and economic outlooks. According to the agreement between IMF staff and Kenyan authorities, the ongoing Extended Fund Facility and Extended Credit Facility programs won’t proceed to their ninth review as planned. The Kenyan administration has officially sought a fresh program from the IMF, and the organization will keep collaborating with them,” stated the IMF.

What effect will the IMF's departure have on Kenya?

The geopolitical economist Aly-Khan Satchu stated INSPIRATIONS DIGITAL.co.ke In an exclusive interview, they warned that Kenya's departure might initiate a detrimental chain of events, causing increased Eurobond yields and a devalued shilling.

Sachin argues that from a financial market standpoint, Kenya’s departure from its IMF program will likely be seen as entirely negative. Consequently, we can anticipate a detrimental cycle affecting Eurobond yields (which will rise) and the shilling (which will weaken). This is due to investors generally regarding an IMF program as a crucial safeguard and support mechanism.

Satchu observed that Nairobi might have decided to step down after thorough contemplation due to widespread public outrage regarding IMF stipulations, such as broadening the tax net, cutting back on subsidies, and implementing reforms for state-owned enterprises.

"Kenya determined that pushing tax revenues any further would likely trigger additional unrest, and I'm certain that deciding to leave the program wasn't taken lightly," he explained.

The economist suggested that Kenya's recently secured $2 billion loan from the UAE reflects changes in their borrowing strategies.

After leaving one program, joining another entirely new one takes some time. It seems like Kenya has substituted the IMF with the UAE, or at least believes it has done so.

What is Kenya's debt?

As the Ruto administration keeps increasing its borrowings, the nation's debt has climbed to KSh 11.02 trillion by January 2025.

The external debt was at KSh 5.09 trillion whereas the domestic debt climbed to KSh 5.93 trillion.

The IMF cautioned that the country faced potential threats from rising debt levels.

No comments:

Post a Comment