From Venice to Barcelona, popular tourist spots are overwhelming visitors. However, do these measures truly alleviate overtourism, and what happens with the generated revenue?

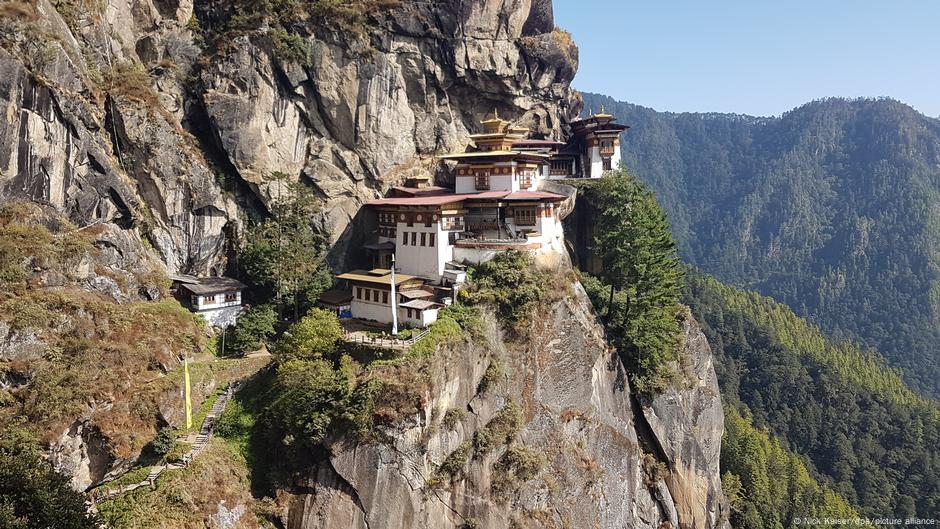

The high tourist taxes didn’t deter 39-year-old Susanne Meier from making two trips to the Himalayan nation of Bhutan. Interestingly, this country has the globe’s priciest tourist tax called the “Sustainable Development Fee.” Visitors must pay $100 (€95) per person each day they spend there—a considerable expense for many tourists. tourism tax is added to the extra travel expenses, including those for a driver and guide, typically provided by tour operators at an additional cost.

"People there prefer sustainable tourism over inexpensive tourism," explains Meier, who is employed by Bhutan Travel located in Moosburg, Bavaria. She adds that her clients are content with paying the additional taxes once they realize the beneficial impact these have locally.

Taxes contribute to enhancing facilities in Bhutan.

The nation’s tourism body indicates that these funds are channeled directly into aiding Bhutan's roughly 800,000 residents. The government allocates visitors’ contributions toward enhancing healthcare services, advancing educational facilities, upgrading public infrastructures, as well as bolstering programs aimed at environmental conservation and supporting small enterprises locally.

The country reported earning $26 million (€25 million) in revenue in 2023 from the fee.

Certainly with such a high tourism tax acts also as a deterrent: Authorities reported that just 103,000 tourists visited the country in 2023. The majority of those tourists were from India, the only country where travelers pay a lower daily tax to visit.

With 962,000 million inhabitants, the population of the Spanish island of Mallorca is similar to that of Bhutan, however, locals have been inundated with tourists in recent years and have staged numerous protests .

Approximately 13 million tourists visited the island in 2024. Consequently, it comes as little surprise that numerous locals have been advocating for restrictions on mass tourism.

In 2016, the island introduced an accommodation tax. According to the hotel classification, visitors may have to pay up to €4 ($4.16) daily. As per the plan proposed by the Balearic Islands' government, the levy might increase up to six euros. The funds are utilized to support initiatives focused on rendering Mallorca more environmentally friendly. Nonetheless, this levy has had minimal impact on discouraging visitors; the island continues to break annual tourist arrival records each year.

Tourism accommodation taxes have minimal impact on deterring visitors.

"As stated by Jaume Rossello, an economics professor at the University of the Balearics in Palma de Mallorca, the impact of these taxes on tourism demand is minimal," he notes.

In Barcelona, For instance, travelers presently incur costs as high as €7.50 each day, varying based on the hotel classification. In Berlin, however, a levy of 7.5% on the cost of an overnight stay applies, whereas in Paris, guests could be required to pay nearly €16 nightly for top-tier accommodations. Nonetheless, Rossello indicates that it remains uncertain at which point tourists would begin reconsidering their options. changing their destination .

As stated by Professor Harald Zeiss from the Institute for Sustainable Tourism in Wernigerode, Germany, numerous locations utilize the income generated from tourist taxes to compensate environmental impacts "At the very least, this is how it’s portrayed whenever these taxes are being proposed and implemented,” he adds.

Nonetheless, the actual utilization of these funds differs significantly. They might be allocated for fostering eco-friendly transportation systems or merely bolstering municipal finances. "Therefore, it’s essential to allocate resources with clear transparency," emphasizes Zeiss. "But when budgets lack funding, their designated purpose tends to be loosely interpreted."

Loathe to criticize tourism

In numerous tourist hotspots, revenues generated from tourism taxes constitute a substantial part of the city’s overall tax earnings. For instance, in Barcelona, these taxes bring in approximately €100 million ($104 million) annually, placing them as the third-highest contributor to municipal funds, based on data provided by the local government. Despite this financial boost, the city continues to grapple with vehement anti-tourism demonstrations sparked by rising rental costs attributed largely to short-term vacation accommodations offered by firms such as Airbnb As a consequence, officials in Barcelona have decided to concentrate their efforts on funding initiatives that serve the local community rather than solely benefiting the tourism industry. Approximately €100 million ($104 million) collected through taxes levied on tourists' overnight stays will be invested in the city’s School Climate Plan. This plan aims to install air conditioning systems in all of Barcelona's schools.

The revenue from the overnight accommodation tax in Berlin, also known as the City Tax, has not yet been earmarked. The money, which was almost €90 million in 2024, currently flows into the city's general budget.

In Amsterdam, a tourist tax has been implemented since 1973. The current rate stands at 12.5% of the cost of an overnight stay, with projections estimating this will yield approximately €260 million in income for 2025, as stated by a representative from the municipal government. Local authorities argue that the levy serves not only as a significant financial resource but also as a mechanism to manage visitor numbers. Nonetheless, experts believe that this tax may have limited impact as a disincentive for tourists.

Venice makes changes

Following considerable discussion, Venice, Italy finally implemented its highly anticipated tourism levy in 2024. During 29 high-season days, day trippers were required to pay an entry fee of €5. However, opposition politicians argued that this charge was insufficient to discourage visitors from flocking to the overburdened city. Consequently, Venice increased the number of charging days to 54. Now, individuals must settle the fee at least four days prior to their arrival; otherwise, they face a higher rate of €10 upon payment.

Whether or not potentially paying a few extra euros will deter anyone from visiting the sinking city remains to be seen.

Jaume Rosselló, a researcher affiliated with the University of the Balearic Islands, expresses skepticism. According to him, for many individuals, taking a holiday isn’t considered an extravagance but rather a fundamental requirement. To illustrate this point using Mallorca as an instance, he mentions how most visitors readily settle their accommodation taxes without complaint. “Such levies tend to be quite popular,” remarks Rosselló, “especially when they help enhance the environmental stewardship of a location.”

Nevertheless, numerous travelers still face constraints, which the case of Bhutan illustrates. After increasing the tourism levy from $65 to $200 following multiple decades at the lower rate, fewer visitors opted for vacations in Bhutan. Susanne Meier observed a distinct change: "The booking numbers reflected this shift. No one wished to cover such costs."

This article was translated from German.

Author: Jonas Martiny

No comments:

Post a Comment