The primary cause for the Bank of Portugal having to replace approximately 317,000 damaged banknotes valued at about €13.8 million over the past ten years is due to individuals burying them. These people later turn these notes in with the intention of reclaiming their monetary value.

José Luís Ferreira, who leads the cash operations at Banco de Portugal, explained to Euronews: "The notes get damaged due to moisture, and many also get spoiled when buried underground. The combination of soil dampness and insect activity further accelerates their deterioration."

Though often concealed out of sight, human ingenuity in stashing cash can be quite boundless. Individuals have been known to secret their savings inside appliances like microwaves, within hearths such as fireplaces, or even beneath sewage systems like septic tanks.

For José Luís Ferreira, this behavior could stem from a distrust of banks or serve as a means to have immediate access to liquidity during unexpected circumstances.

"People think that hiding banknotes will protect their personal valuables from theft and other natural catastrophes. And this practice continues to carry a lot of weight among less literate people," he says.

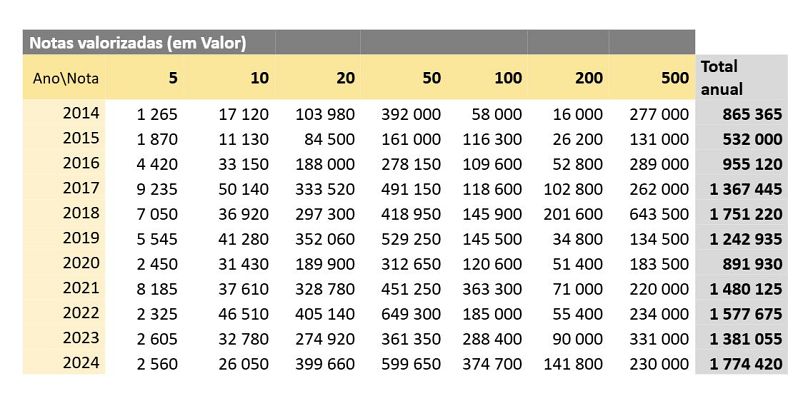

In 2024, over 40,000 banknotes were appraised, predominantly consisting of €20 bills (19,983) and €50 bills (11,993). This evaluation amounted to more than €1.7 million, marking the peak valuation since 2014.

The framework governing cash flow in Portugal influences how individuals accumulate their savings and choose their means of storing wealth.

This can be seen from the rise in value of the €20 bills.

Regarding the €50 note, "this might be explained by the preference of individuals to keep wealth stored in higher denominations, thereby reducing the physical space required for storage," clarifies the head of the central bank’s cash operations division.

The pandemic led to an increase in hidden money.

In 2014, the peak year for the surrender of banknotes saw a significant spike in 2022, totaling 40,954 notes (worth approximately €1.5 million). This increase can be attributed primarily to the effects of the COVID-19 pandemic, which led to a higher demand for storing wealth.

After the pandemic ended, individuals with damaged possessions they had kept at home headed to the Bank of Portugal for an exchange.

José Luís Ferreira also recalls 2018 as a high point for banknote retrieval services, largely because of the devastating wildfires that occurred towards the close of 2017. During that period, approximately 32,000 banknotes were retrieved, amounting to a total value of €1,751,220.

The head of the Bank of Portugal described one scenario where the proprietor of a timber mill located in the heart of the country faced a crisis. This individual relied on cash stored in a safe to meet payroll obligations for employees but found the money endangered when the safe caught fire. The amount involved totaled €40,000.

What process is followed for analyzing requests regarding the valuation of banknotes?

The standards for evaluating banknotes are uniform across the Eurozone. Consequently, every central bank within the member nations that adopted the euro must adhere to these identical requirements.

"The pieces composing a banknote should collectively exceed 50% of the total bill. These components must also enable identification as belonging to authentic currency. Our specialists, equipped with specialized tools, examine these sections to detect security features that help determine if the piece indeed originates from an original banknote," clarifies José Luís Ferreira.

For this task, the group of technical experts depends on software created in Portugal that swiftly evaluates the dimensions of the banknote fragment relative to its overall surface area. This apparatus can sum multiple pieces and determine the remaining percentage of the banknote.

To ensure a refund, it must also be proven that the cause of the damaged currency aligns with the explanation provided by the individual who submitted it, as fraudulent cases might not qualify for reimbursement.

Some individuals attempt to mislead the technicians with the aim of profiting from counterfeit schemes. Should it be determined that the bills are fake, this information is relayed to the appropriate authorities, leading to the confiscation of the funds.

"Time and again, we receive letterheads stating that certain documents have been damaged, suggesting this damage was responsible for their altered appearance as an attempt to hide forgery or counterfeiting. However, such claims rarely succeed in navigating our rigorous procedures. Our inspection methods are highly effective, allowing me to confidently assert that every effort to mislead the bank into honoring these documents is successfully detected and rejected," asserts the head of Banco de Portugal’s currency operations division.

No comments:

Post a Comment