US President Donald Trump's new global tariff regime , scheduled to be revealed on April 2, appears quite similar to Alice in Wonderland The notoriously vanishing Cheshire Cat, which occasionally faded away until only its enigmatic grin remained and delighted in confusing Alice.

I feel that even as late as April 2nd, we'll still have more uncertainties than clarifications. This week, Treasury Secretary Steven Mnuchin tried to shed some light on expectations. He mentioned that the U.S. plans to release a list detailing other nations' tariffs: “We aim to inform these countries that we believe their tariff rates, non-tariff barriers, currency manipulations, biased subsidies, and labor suppression practices should change; otherwise, we’ll erect our own tariff barrier.”

And if a nation does not alter those policies, then we will raise the tariff barriers to safeguard our economy, shield our workforce, and defend our industries." Even now, I can envision the Cheshire Cat’s grin.

Are you curious about the most significant issues and global trends? Find out here. SCMP Knowledge Our latest platform features handpicked content including explainers, FAQs, analyses, and infographics, all provided by our prestigious team.

He pointed out a "Filthy Fifteen" – the 15 percent of global economies with the highest trade barriers against the United States – stating that these would be the main targets for the retaliatory tariffs set to take effect in April.

If this list is based on those with whom the US runs the largest trade deficits, it would start with China, Mexico and Vietnam, and continue with Ireland, Germany, Taiwan, Japan, South Korea, Canada, Thailand, India, Italy, Switzerland, Malaysia and Indonesia.

However, the Cheshire Cat appears once more: this list only assesses their merchandise trade surplus with the United States. It does not consider “non-tariff barriers, currency manipulation, unfair financing, labor repression.” As far as I know, there isn’t any measurement that attempts to gauge these elements and integrate them with trade statistics. Therefore, Bessent’s remarks appear destined to muddy the waters.

Later, The White House tried to provide additional explanation: “If the tariff and non-tariff barriers aren’t balanced, or if the U.S. maintains lower tariffs, then these tariffs will come into play.” This statement was just as clear as murky water. It might imply that Trump is basing his decisions on mean tariff levels. According to World Bank data from 2022, which shows averages until that year, the United States had an average tariff rate of about 1.5 percent (a figure that has significantly increased recently). In contrast, this places India’s average around 11.5 percent and China’s near 3.1 percent.

Would this mean India dealing with U.S. retaliatory tariffs of 10 percent and China Considering a rate of 1.6 percent? For instance, what about Vietnam with an average of 1.1 percent, or Germany which has a rate of 1.3 percent? Does this imply these countries would get tariff reductions? And if we included the value-added tax, could it result in Germany facing reciprocal tariffs exceeding 17 percent?

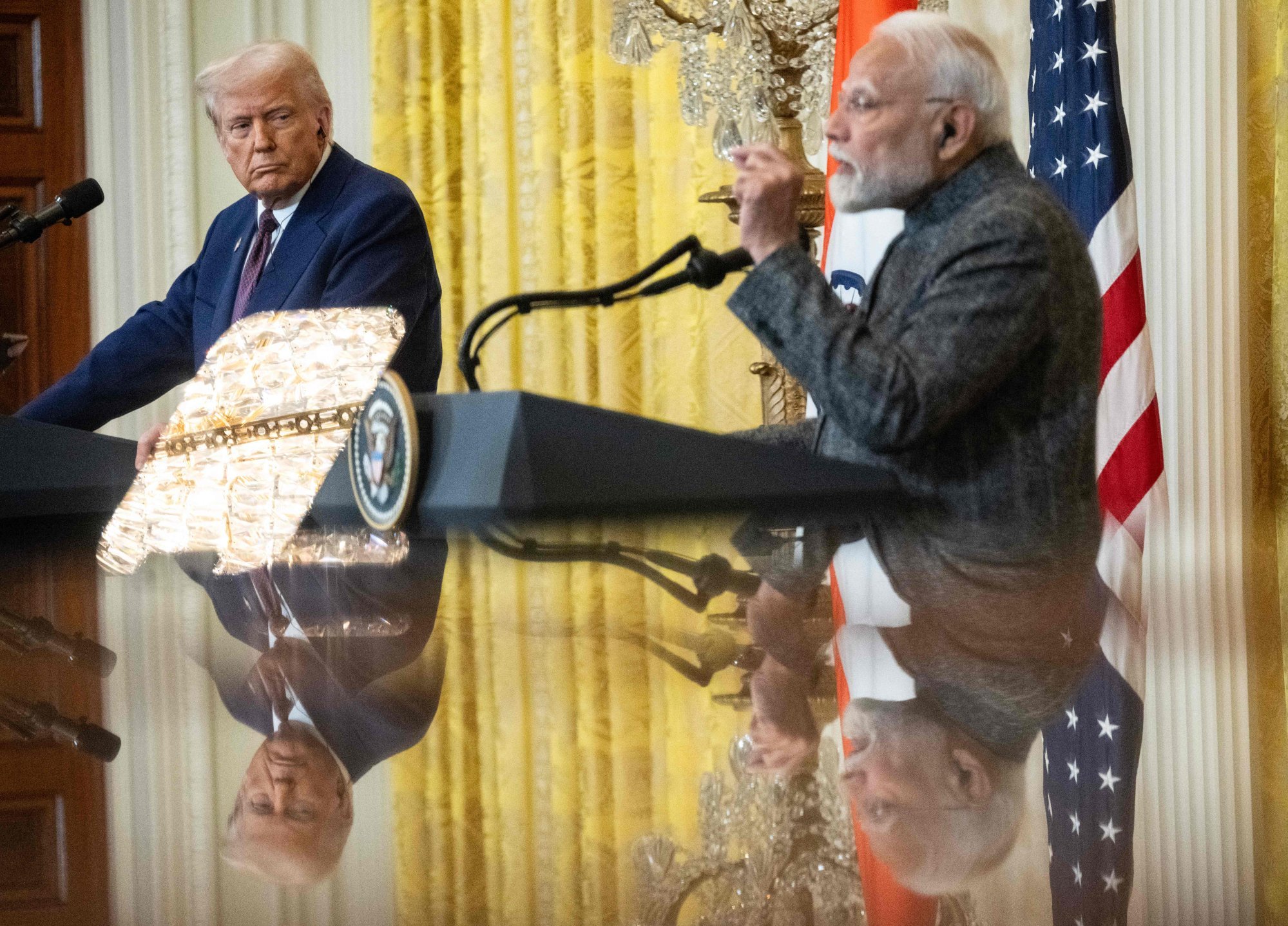

Maybe the sole method to truly understand the immense complexity involved in determining reciprocal tariffs with accuracy involves focusing on just one nation. Consider India, which undoubtedly appears on Trump’sDirty 15list, as he explicitly called it out as a tariff offender. March 4 address to Congress.

Since January, India has been involved in intense diplomatic efforts with Trump's followers. visited Washington In February, while Piyush Goyal, his Commerce and Industry Minister, was holding office, intensive talks In line with previous discussions earlier this month, talks are underway aiming for a US-India trade deal by October.

Last year, the United States stood as India’s top export destination with sales totaling approximately $74 billion, maintaining a trade surplus exceeding $40 billion. This significant economic relationship renders the U.S. marketplace crucial for India and cements its position within the Dirty 15 ranking. However, a substantial portion of these exports from India consists of generic drugs .

Indian pharmaceutical companies supply almost half of the generic drugs purchased in the US, accounting for nine out of every ten prescriptions written. This saves Americans more than $200 billion annually. Imposing a 10 percent retaliatory tariff on these medications could primarily harm American patients who rely on them.

India has some of the world’s highest protective barriers for its agricultural sector, with an average tariff of 38 percent, compared to America's 2.59 percent. Were President Trump to apply equivalent tariffs based on this disparity, the rate could rocket up to a damagingly high 35 percent. Therefore, should we consider the U.S. imposing either a 10 percent or a 35 percent tariff?

Will he establish varying rates for distinct sectors based on their significance? This could lead to an immense challenge when performing these computations. Given that the US engages in trade with approximately 200 economic entities through roughly 13,000 tariff categories, which equates to about 2.6 million separate duties, the process becomes overwhelming. Considering the limited resources—overstressed customs personnel and only 200 employees at the U.S. Trade Representative’s office—the job of formulating, enforcing, and monitoring the updated tariffs seems nearly unmanageable.

Once the reciprocal tariffs for India have been calculated, the U.S. runs into strong opposition from the World Trade Organization's regulations. "most favoured nation" Trading rule: A price quote provided to one trade participant should also apply to all others. For many years, this principle has been fundamental to the structured international trading framework—not only due to its fairness but also because it simplifies the process significantly, eliminating the complexities associated with monitoring tariffs on a nation-by-nation basis.

As Indian politician Shashi Tharoor penned recently: "India strongly favors protective measures, a stance deeply ingrained due to its historical experiences with colonization, and this mindset won’t change overnight." Additionally, the administration is unlikely to forsake the cherished "special and differential treatment" provided by the WTO to emerging nations such as India, which shields them from duties considered burdensome. However, these protections would likely dissolve under President Trump’s proposed tariff regulations.

If you seek clarity on April 2, focusing on India might prove helpful. However, do not be astonished if uncertainty persists, much like the Cheshire cat fading away into a mysterious grin.

More Articles from SCMP

Malaysian man spotted on video concealing Labubu toys in his pants

Coleman Wong makes history as the first Hong Kong tennis player to triumph in an ATP Masters 1000 tournament match.

Chinese young women are finding virtual romances through the popular game 'Love and Deepspace.'

Cathay Pacific Cancels Two Flights to Heathrow Due to UK Airport Blackout

The article initially appeared on the South ChinaMorning Post (www.scmp.com), which is the premier source for news coverage of China and Asia.

Copyright © 2025. South China Morning Post Publishers Ltd. All rights reserved.

No comments:

Post a Comment