Declaring income tax is an annual obligation for millions in Brazil, but it also presents a valuable opportunity to organize finances and ensure all rights are respected. As 2025 approaches, the declaration process introduces new rules and challenges that might bewilder taxpayers, especially those new to the Brazilian system. This guide aims to demystify the 2025 Income Tax declaration process in Brazil, providing a detailed step-by-step approach to help international residents successfully navigate this important task.

Understanding the Importance of Accurate Income Tax Declaration

The significance of declaring income tax correctly extends beyond simply avoiding penalties. It is fundamental to securing access to benefits such as tax refunds, eligible deductions, and even favorable credit terms from financial institutions. A well-prepared and accurate declaration demonstrates financial responsibility and compliance with Brazilian law, which can be crucial for international residents seeking to establish themselves in the country. Failing to accurately declare income can lead to audits, fines, and even legal repercussions, impacting your ability to live and work in Brazil.

Key Dates and Deadlines for the 2025 Tax Year

The filing season for the 2025 Individual Income Tax Return (year-base 2024) runs from March 17th to May 30th. The Brazilian Federal Revenue Service (Receita Federal) anticipates approximately 46.2 million people will file their returns in 2025. It is crucial to mark these dates in your calendar to avoid late filing penalties. Those who fail to submit their declaration or submit it after the deadline will be subject to a fine of at least R$ 165.74, even if no tax is owed. The maximum penalty can reach 20% of the total income tax due. Procrastination can be costly, so gathering your documents and starting the process early is highly recommended.

Changes to the Income Tax Regulations in 2025

Several important changes have been introduced for the 2025 tax year, primarily related to income thresholds and reporting requirements. Two significant changes are linked to the updated progressive income tax table. The taxable income limit has increased from R$ 30,639.90 to R$ 33,888.00. Additionally, the gross revenue limit for rural activities has risen from R$ 153,999.50 to R$ 169,440.00.

Furthermore, two new mandatory reporting requirements have been added. Based on Law n° 14.973/24, individuals who updated the value of real estate assets and paid a differentiated capital gains tax in December 2024 are now required to file. Secondly, Law n° 14.754/23 now mandates reporting of income earned abroad from financial investments and dividends. Be aware of these new requirements as they may affect your tax obligations.

Enhanced Pre-Filled Tax Returns and Digital Accessibility

This year, the pre-filled tax return will include information about bank accounts held abroad, becoming available to taxpayers on April 1st. The Receita Federal estimates that approximately 57% of returns will be submitted in this format in 2025, totaling around 26.3 million. To access this convenient feature, taxpayers must have a "gold" or "silver" account on the Gov.br platform, the Brazilian government's digital services portal. The pre-filled return can significantly simplify the process, reducing the risk of errors and saving time.

Additionally, the Receita Federal has removed some fields from the tax form at the request of taxpayers, streamlining the declaration process. In 2025, it will no longer be necessary to provide your voter registration number (título de eleitor), the code for the consulate/embassy (if residing abroad), or the receipt number from the previous year's return (when filing online). These changes reflect an effort to make the tax filing process more user-friendly.

Essential Documents Required for Filing

To ensure a smooth and accurate filing process, gather all necessary documents before you begin. This includes proof of all income earned throughout the previous year, such as income statements from employers (empresas), government entities (governo), and individual clients (pessoas físicas). Additionally, retain proof of income from financial investments held in banks (bancos) and brokerage firms (corretoras).

Other essential documents include receipts for medical expenses (despesas médicas), including those from hospitals (hospitais), clinics, health insurance plans (planos de saúde), dentists (dentistas), and psychologists. Also, collect proof of educational expenses for yourself and your dependents (gastos para instrução). Individuals paying court-ordered alimony (pensão alimentícia) must retain proof of payments made to the beneficiary. Finally, gather information about any debts incurred during the previous year, as well as documentation related to the purchase or sale of movable and immovable property (compra e venda de bens móveis e imóveis).

The Receita Federal has up to five years to review submitted tax returns, so it is crucial to retain all supporting documentation for the same period. Proper record-keeping is essential for defending your tax position in case of an audit.

Filing Options: Software, App, and Online Portal

With your documents in hand, the next step is to choose your preferred filing method. The primary option is to download the Tax Return Generator Program (Programa Gerador da Declaração - PGD IRPF 2024) from the Receita Federal website. This program is typically available for download starting in mid-March.

Taxpayers can also file using smartphones or tablets by downloading the "Receita Federal" app from the Google Play Store (for Android) or the App Store (for iOS). Alternatively, you can file directly through the Receita Federal's official website. According to statements made by auditors from the agency, the desktop software solution is likely to be discontinued in the coming years, indicating a shift towards online and mobile filing options. Choose the method that best suits your technological comfort and access.

Choosing Between Simplified and Complete Tax Returns

One of the key decisions you'll need to make is whether to file a simplified (Simples) or complete (Completa) tax return. The simplified version is generally suitable for taxpayers with relatively few deductible expenses during the previous year. In this option, a standard deduction of 20% is automatically applied to your taxable income, capped at R$ 16,754.34. This means you forgo the opportunity to claim individual deductions for expenses like education and healthcare.

If you did not receive any taxable income in the previous year, you can choose either model, as there will be no tax to pay or refund in either case. To decide between the "Legal Deductions" (Deduções Legais) or the "Simplified Discount" (Desconto Simplificado) method, you must complete the tax return as usual. Once all data has been entered, consult the "Taxation Option" (Opção pela Tributação) item in the program's left-hand menu. Here, you can choose the option that offers the lowest "effective tax rate" (alíquota efetiva) – the one that results in the lowest tax payable or the highest tax refund.

Determining Your Obligation to File

Not everyone is required to file an income tax return in Brazil. Here's a breakdown of the criteria that trigger the filing obligation:

- Individuals residing in Brazil who had taxable income subject to adjustment exceeding R$ 33,888.00 in the previous year.

- Those who received tax-exempt, non-taxable, or exclusively taxed at source income exceeding R$ 200,000 in 2024, such as donations and inheritances.

- Individuals who had gross revenue exceeding R$ 169,440.00 from rural activities in the previous year.

- Those intending to offset losses from rural activities from previous calendar years or the 2024 calendar year.

- Individuals who, as of December 31, 2024, held assets and rights (such as real estate, vehicles, and investments) with a combined value exceeding R$ 800,000.

- Those who had capital gains from the sale of assets or rights subject to income tax.

- Individuals who carried out disposal (sale) transactions on stock, commodity, and futures exchanges, and similar markets, totaling more than R$ 40,000 during the year, or who had profit subject to tax on sales.

- Those who sold a residential property last year and used the proceeds to purchase another residence for habitation within 180 days of the sale, and opted for income tax exemption.

- Individuals who became residents of Brazil in any month of the previous year.

- Those who hold investments in trusts abroad.

- Those who opted for updating the market value of real estate.

- Those who earned income from abroad derived from financial investments and dividends from controlled companies.

- Those who opted to detail assets abroad of the controlled entity as if they were of the individual.

If you do not meet any of the above criteria, you are automatically exempt from filing an income tax return. Additionally, individuals who are included as dependents in another person's tax return (e.g., children included as dependents of their parents) are also exempt from filing separately.

Understanding the Progressive Tax Table and Rates

The progressive tax table applicable for the 2025 Income Tax (calendar year 2024) is as follows:

| Taxable Base (R$) | Tax Rate | Deduction (R$) |

|---|---|---|

| Up to 26,963.20 | Exempt | – |

| 26,963.21 to 33,919.80 | 7.5% | 2,022.24 |

| 33,919.81 to 45,012.60 | 15% | 4,566.23 |

| 45,012.61 to 55,976.16 | 22.5% | 7,942.17 |

| Above 55,976.16 | 27.5% | 10,740.98 |

The Receita Federal allows an annual deduction per dependent of R$ 2,275.08, and the annual expense limit for education is R$ 3,561.50. Understanding these tax brackets and deductions is crucial for accurately calculating your tax liability.

Reporting Income and Claiming Deductions

It is essential to declare all sources of income, including salaries, service fees, income as a company partner, and retirement income. Income from foreign sources must also be declared, as well as income received from other individuals, such as rental income or alimony. Even income that is not subject to taxation, such as savings account interest, must be reported.

All income earned from financial investments must be declared, including automatic investments made by banks from current account balances. Income received cumulatively, such as salaries, pensions, or retirement payments deposited in a lump sum due to legal action, must be reported under "Accumulated Income Received" (Rendimentos Recebidos Acumuladamente - RRA).

All payments made to individuals must also be reported, including alimony (resulting from court decisions), rent, rural leases, education expenses, and payments to self-employed professionals such as doctors, dentists, psychologists, lawyers, engineers, architects, brokers, teachers, and mechanics. Payments to legal entities, when deductible, must also be reported. Furthermore, all assets and rights that constituted your patrimony (and that of your dependents) on December 31, 2024, must be declared. Donations made to individuals, legal entities, entities, and political parties must also be included in the Income Tax Return.

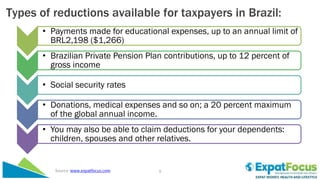

Claiming Eligible Deductions to Reduce Taxable Income

Tax deductions are expenses incurred during the calendar year that can reduce the amount of tax owed or increase the refund amount. These expenses include those related to health, education, private pension plans (PGBL), alimony, and dependents.

Health-related deductions include expenses for private medical consultations, plastic surgeries, hospitals, dental treatments, physical therapy, laboratory tests, radiological services, orthopedic devices, and dental prostheses. Medical expenses incurred abroad can also be deducted.

Education-related deductions can be claimed for expenses incurred for yourself and your dependents. Only expenses related to early childhood education (daycare and preschool), elementary and secondary education, higher education (undergraduate, postgraduate, master's, doctorate, and specialization), and technical and technological education are deductible. Deductions for other language courses, such as English classes, or sports and music lessons, are not permitted.

For alimony, the payer can deduct the expense from their return if the alimony has been defined by court order or public deed. However, the taxpayer paying alimony cannot include the child as a dependent.

Donations made to funds controlled by municipal, state, district, and national councils for the Rights of the Child and Adolescent, funds controlled by national, district, state, or municipal councils for the Elderly, and the National Culture Fund (FNC), among others, are also deductible.

The deduction limits are as follows:

- Health expenses: no limits, within the rules of the Receita Federal.

- Education expenses: R$ 3,561.50 per year for expenses with the education of the taxpayer, dependents, or alimony recipients.

- Complementary pension plans: Up to 12% of taxable income.

- Donations to children and adolescents, the elderly, and culture: Limited to 6%.

- Dependents: R$ 2,275.08 per dependent, according to the rules of the Receita Federal.

Understanding the Restitution Schedule and Priorities

The tax refund payments are made in five batches, starting in May. The first batch is scheduled for May 30th, and the last for September 30th. As in previous years, priority will be given to the elderly, individuals with serious illnesses, and physically and mentally disabled persons. Following these groups, priority is given to taxpayers who submitted their return early, without errors or omissions, and those who simultaneously used the pre-filled return and opted to receive their refund via Pix (the Brazilian instant payment system).

Here is the restitution schedule:

1st batch: May 30th 2nd batch: June 30th 3rd batch: July 31st 4th batch: August 29th 5th batch: September 30th

If you do not receive your refund by the last batch, it is possible that your return has been flagged for further review (malha fina). You can check the status of your return on the Receita Federal website.

Filing your Brazilian income tax return accurately and on time is crucial for maintaining your legal status and accessing financial benefits. By understanding the new regulations, gathering the necessary documents, and choosing the appropriate filing method, you can navigate the 2025 tax season with confidence. Remember to consult with a qualified tax professional if you have any complex questions or need personalized guidance.

No comments:

Post a Comment