The relentless surge in global inflation, combined with persistent geopolitical instability and simmering recession fears, has catapulted gold prices to unprecedented levels in 2024 and 2025. Breaching the US$2,450 per ounce mark in 2024 and setting new all-time record of $3,528.78 per ounce in 2025, gold has solidified its position as a premier safe-haven asset. This surge in demand, coupled with growing concerns about gold mine supply, has trained a sharp focus on the world's leading gold-mining companies. How are they responding to these dynamic market forces? Which firms are best positioned to capitalize on this golden opportunity? This article delves into the top gold producers, their strategies, and the factors shaping the industry in this era of record-breaking prices.

Global Gold Consumption and Market Dynamics

According to the World Gold Council's annual report, robust central bank purchases and rising investor interest propelled global gold consumption to new heights in 2024. Central banks' "insatiable" appetite for gold saw purchases exceeding 1,000 tons for the third consecutive year, marking a significant turning point. Investment in gold surged by 25%, largely driven by gold exchange-traded funds (ETFs), reaching a four-year high of 1,180 tons. Furthermore, strong demand for gold bars and coins continued, fueled by increased purchasing activity in China and India.

However, this impressive performance masks underlying challenges in key consumer markets. Despite the overall surge, physical demand for gold has declined in China and India due to record-high prices. According to the Perth Mint, gold sales in January hit a 10-month low, while silver sales plummeted 61% from the previous month. This disparity suggests that while investment demand is robust, the retail and jewelry industries are facing pressure from elevated prices.

Citigroup has maintained a positive outlook, keeping its 6–12 month projection at $3,000 per ounce and updating its short-term (0–3 months) price target to $3,000 per ounce from $2,800. Moreover, the bank increased its average price forecast for 2025 from $2,800 to $2,900 per ounce. Citi anticipates continued gold price appreciation as a hedge against growth risks, including trade wars, high interest rates, a deteriorating U.S. labor market, currency devaluation risks, and potential U.S. equity drawdowns.

Trade Wars and Economic Uncertainty Bolster Gold's Appeal

Escalating trade tensions, particularly those ignited by the U.S., further amplify gold's safe-haven allure. As Ricardo Evangelista, senior analyst at ActivTrades, noted, the imposition of tariffs increases the attractiveness of gold. Combined with concerns about a potential slowdown in the U.S. labor market, these factors reinforce dovish expectations for the Federal Reserve, providing additional support for gold prices. In 2025, these market dynamic continue to propel gold's safe-haven status as global uncertainty looms.

Top Gold Mining Companies Responding to Market Dynamics

In 2023, global gold production reached 3,000 metric tons, with China, Australia, and Russia leading the way. However, the focus is shifting to the companies driving this production. Here's a look at the top gold-mining companies in 2023 and the first half of 2025, reflecting their production levels, strategies, and recent developments:

- Methodology: The data is largely based on LSEG, a leading financial markets data provider, with numbers reported in US tons for 2023 and kilo ounces (koz) for the first half of 2025.

The Giants of Gold Mining in 2023

-

Newmont (TSX:NGT, NYSE:NEM)

- Production: 172.3 tons

- Newmont is the world's largest gold-mining company, with operations across North and South America, Asia, Australia, and Africa. The company's significant acquisitions, including Goldcorp in 2019 and Newcrest Mining in 2023, have solidified its dominance. Newmont anticipates producing 6.9 million ounces of gold (215.6 tons) in 2024.

-

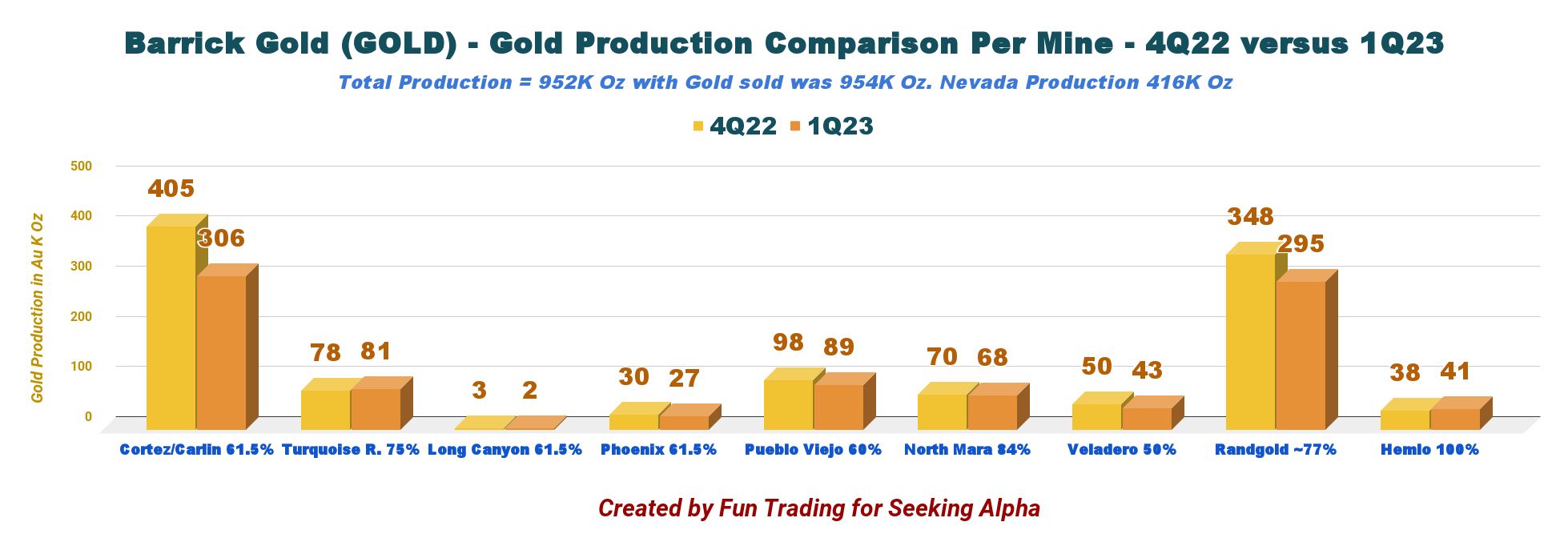

Barrick Gold (TSX:ABX, NYSE:GOLD)

-

Production: 126 tons

- Barrick Gold, a major player in the industry, has been actively involved in mergers and acquisitions, including a joint venture with Newmont called Nevada Gold Mines. Its key mines include Pueblo Viejo in the Dominican Republic and Loulo-Gounkoto in Mali. The company has set its 2024 production guidance at 3.9 million to 4.3 million ounces (121.9 to 134.4 tons).

-

Agnico Eagle Mines (TSX:AEM, NYSE:AEM)

-

Production: 106.8 tons

- Agnico Eagle Mines, with 11 operating mines in Canada, Australia, Finland, and Mexico, achieved record annual production in 2023. The company's acquisition of Yamana Gold's assets in early 2023 further boosted its portfolio. Gold production for 2024 is expected to reach 3.35 million to 3.55 million ounces (104.7 to 110.9 tons).

-

Polyus (LSE:PLZL, MCX:PLZL)

-

Production: 90.3 tons

- Polyus, the largest gold producer in Russia, boasts the highest proven and probable gold reserves globally. With six operating mines in Eastern Siberia and the Russian Far East, Polyus expects to produce approximately 2.7 million to 2.8 million ounces (84.4 to 87.5 tons) of gold in 2024.

-

Navoi Mining and Metallurgical Company

-

Production: 88.9 tons

- Navoi Mining, operating since the 1960s, is a significant gold producer from Uzbekistan. The company aims to expand its production to over 3 million ounces of gold per year by 2025.

-

AngloGold Ashanti (NYSE:AU, ASX:AGG)

-

Production: 82 tons

- AngloGold Ashanti operates nine gold mines in seven countries across three continents. The majority of its production comes from its African operations. For 2024, the company's production guidance is set at 2.59 to 2.79 million ounces of gold.

-

Gold Fields (NYSE:GFI)

-

Production: 71.7 tons

- Gold Fields, a globally diversified gold producer, has nine operating mines in Australia, Chile, Peru, West Africa, and South Africa. The company's output guidance for 2024 is in the range of 2.33 million to 2.43 million ounces (72.8 to 75.9 tons).

-

Kinross Gold (TSX:K, NYSE:KGC)

-

Production: 67 tons

- Kinross Gold has six mining operations across the Americas and East Africa. The company attributed its 10% production increase in 2023 to higher levels at its La Coipa mine in Chile and Tasiast. Kinross is on track to meet its 2024 guidance of 2.1 million ounces.

-

Freeport-McMoRan (NYSE:FCX)

-

Production: 62 tons

- Primarily known for its copper production, Freeport-McMoRan also produces significant amounts of gold, primarily from its Grasberg mine in Indonesia. The company lowered its 2024 guidance to 1.8 million ounces due to changes in mine sequencing at Grasberg.

-

Solidcore Resources (AIX:CORE)

-

Production: 53.72 tons

- Formerly known as Polymetal International, Solidcore Resources operates two mines in Kazakhstan. The company's 2024 guidance is about 475,000 ounces of gold equivalent from its remaining assets.

The gold market continues to evolve rapidly. Here's a snapshot of the top 10 gold producers in the first six months of 2025:

-

Newmont (NYSE: NEM, TSX: NGT)

- Production: 3,383 koz (-5% YOY)

- Despite selling non-core assets, Newmont remains the top producer with improved business efficiency.

-

Agnico Eagle Mines (NYSE, TSX: AEM)

- Production: 1,740 koz

- Agnico's strong performance, driven by its Canadian mines, positions it as a consistent top performer.

-

Barrick Mining (NYSE: B, TSX: ABX)

- Production: 1,555 koz (-16.7% YOY)

- Barrick's output declined due to the seizure of its mine in Mali and maintenance at Nevada operations, reflecting a strategic shift towards copper.

-

Navoi Mining

- Production: 1,538 koz (+1.6% YOY)

- Navoi's steady performance is supported by the vast Muruntau deposit and ongoing expansion efforts.

-

AngloGold Ashanti (JSE: ANG, NYSE: AU, ASX: AGG)

- Production: 1,524 koz (+21.5% YOY)

- AngloGold Ashanti's significant increase is attributed to its acquisition of Centamin and the Sukari mine in Egypt.

-

Zijin Mining

- Production: 1,324 koz (+16.3% YOY)

- Zijin's growth is fueled by its acquisition of the Raygorodok mine in Kazakhstan.

-

Polyus

- Production: 1,311 koz (-11% YOY)

- Despite a production decline, Polyus saw a profit jump due to high gold prices.

-

Gold Fields (JSE: GFI)

- Production: 1,171 koz (+22.7% YOY)

- Gold Fields is set to expand its portfolio with the acquisition of Gold Road Resources.

-

Kinross Gold (TSX: K)

- Production: 1,060 koz

- Kinross Gold maintains steady production with potential growth from its investment in Eminent Gold.

-

Northern Star Resources (ASX: NST)

- Production: 784 koz (-1.6% YOY)

- Northern Star Resources is consolidating its position with the acquisition of De Grey Mining.

Investment Considerations and Hedge Fund Sentiments

For investors looking to capitalize on the gold market, it's essential to consider the hedge fund sentiments surrounding these companies. Examining the VanEck Gold Miners ETF holdings provides insights into which stocks are attracting significant investment. Stocks that hedge funds pile into often show potential for outperforming the market. For instance, Gold Fields Limited (NYSE:GFI) is a prominent player with diverse assets in multiple countries. In 2024, GFI entered into an agreement with Torq Resources Inc. for the Santa Cecilia Project, investing $48 million for up to 75% stake. Analysts predict substantial sales and EPS growth for GFI in the coming years.

Wheaton Precious Metals Corp. (NYSE:WPM), a Canadian multinational corporation focused on precious metal streaming, is another noteworthy option. WPM reported strong production and sales figures in the third quarter of 2024 and has expanded its portfolio with streaming agreements for the Kurmuk project in Ethiopia and the Kona project in Côte d’Ivoire.

Challenges and Opportunities Ahead

While the gold market presents significant opportunities, gold mining companies also face challenges. Declining physical demand in key consumer markets, geopolitical risks, and operational issues can impact production and profitability. However, the long-term outlook remains positive, driven by continued investor demand and central bank purchases.

As the golden age continues, these top mining companies are poised to navigate the market dynamics and capitalize on the rising gold prices, ensuring that they remain at the forefront of this lucrative industry.

No comments:

Post a Comment