The race to dominate the artificial intelligence landscape is driving unprecedented levels of investment in infrastructure, particularly data centres. A senior policy advisor on artificial intelligence recently emphasized the importance of infrastructure development, echoing a sentiment widely held across Silicon Valley: "Build, baby, build."

This call to action is translating into massive financial commitments. Meta anticipates spending $600 billion on AI infrastructure, including expansive data centres, by 2028. OpenAI and Oracle have unveiled plans for a staggering $500 billion data centre project, known as Stargate. Amazon is also projected to spend upwards of $30 billion on capital expenditures (capex) in each of the coming financial quarters.

However, this massive investment raises a critical question: Is the business case for AI robust enough to justify such immense spending? The potential rewards are significant. Successful AI applications could propel economic growth and revolutionize entire industries. Conversely, a failure to realize sufficient returns could lead to severe economic consequences, including stock market instability and the abandonment of costly, underutilized data centres.

Recent reports indicate a significant expansion of the data centre industry. One comprehensive study identified 1,240 data centres already constructed or approved for construction in the United States by the end of 2024, representing nearly a fourfold increase since 2010. This data excludes projects approved in the current year, suggesting continued growth.

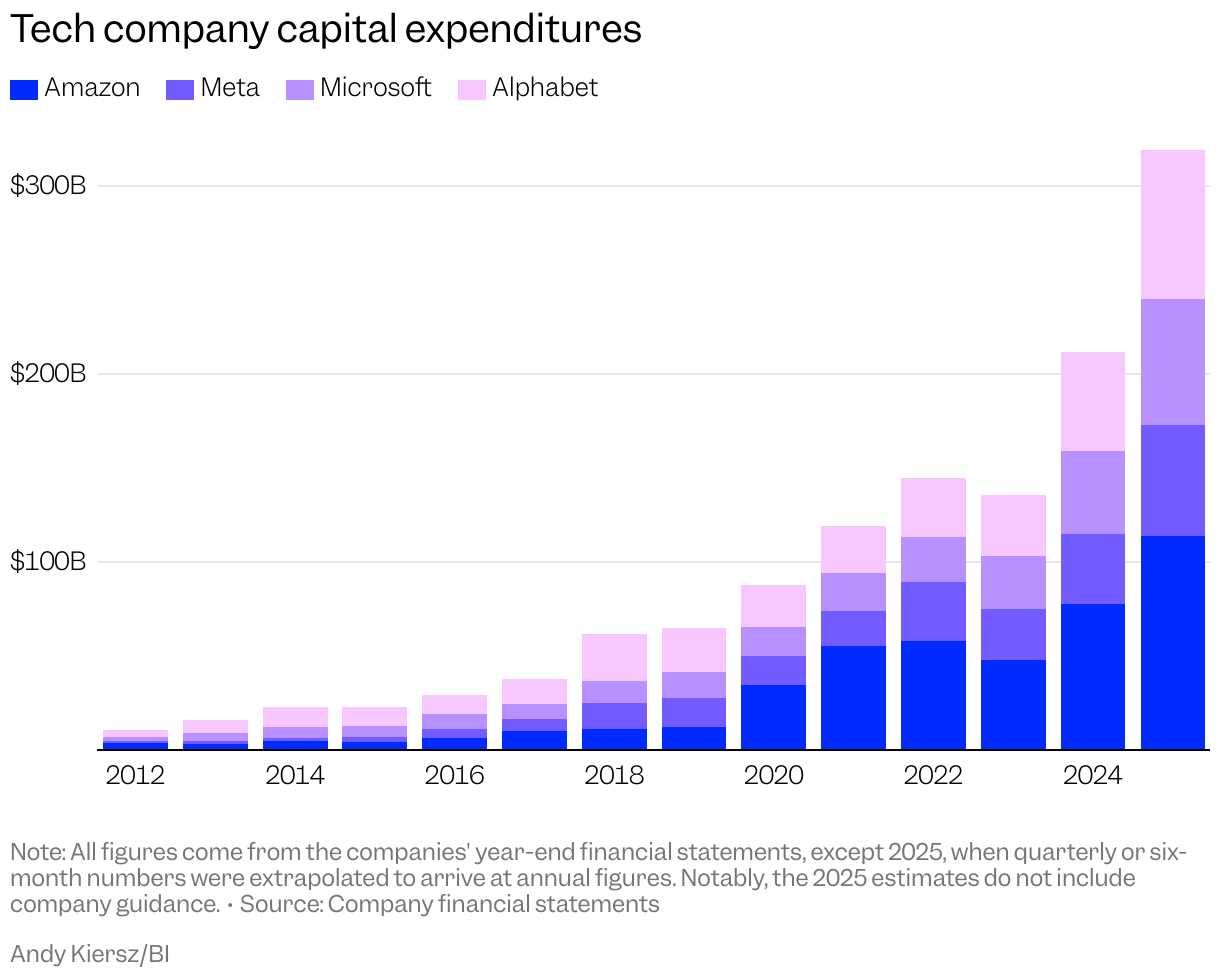

Leading technology companies, including Amazon, Meta, Microsoft, and Google, are driving this expansion. Their combined capital expenditure on AI infrastructure is estimated at $320 billion, exceeding the GDP of Finland and approaching ExxonMobil's total revenue in 2024.

The sheer scale of this investment has triggered concerns about a potential bubble and the risk of a market correction. Despite these concerns, investor confidence remains high. The Nasdaq index is up significantly this year, with Nvidia, Google, and Microsoft experiencing substantial stock price increases. Oracle's stock has also seen remarkable growth.

Notably, spending on AI infrastructure and software has contributed more to GDP growth than consumer spending, according to some economic analyses. This construction boom is transforming landscapes, straining water resources, and placing significant demands on the power grid. The scale of the ambition evokes comparisons to historical projects such as the Apollo space program and the interstate highway system.

OpenAI's finance chief likened the current AI spending to the early stages of railway development, suggesting that the industry is only beginning to realize its potential. The goal is to create a comprehensive network of AI infrastructure that spans the globe.

If these investments prove successful, data centres could become the foundation of the next tech cycle, enabling companies to rent out intelligence and offer high-margin subscription products based on AI agents and custom models.

However, history offers cautionary tales. Overinvestment in railways during the 19th century led to financial crises, leaving investors and banks with substantial losses. Similarly, the fiber-optic boom of the early 2000s resulted in a bust that wiped out trillions of dollars in shareholder value.

The current AI infrastructure boom rests on the assumption that increasing computing power leads to better AI models. This approach involves feeding massive datasets into large language models, which then identify patterns and signals. The theory suggests that models improve by ingesting and analyzing ever-increasing amounts of data, necessitating more powerful computing infrastructure.

This need for scale is shaping the competitive landscape, driving companies to secure as much computing power as possible through the construction of vast data centres filled with powerful GPUs.

OpenAI's CEO has envisioned a future where unlimited computing power enables AI to solve critical problems such as curing cancer and providing personalized education. However, some experts question the validity of this approach.

Critics argue that the focus on scaling is misguided and that simply adding more computing power does not guarantee better AI models. The launch of GPT-5, OpenAI's latest model, was seen by some as an incremental improvement, challenging the notion that increased computing power automatically translates to superior performance. Leading language models still exhibit limitations, such as making simple mistakes and generating inaccurate information.

Studies have also questioned the actual utility of current AI applications. One report suggested that the majority of early corporate AI initiatives have yet to deliver a return on investment. The term "workslop" has been coined to describe substandard AI-assisted output that requires significant fact-checking and correction by human colleagues.

It remains unclear whether the revenue generated from AI products will justify the massive spending on infrastructure. Estimates suggest that significant annual revenue will be needed to justify the projected capital expenditure on computing needs. This will require the industry to develop new products and services beyond simply improving existing business processes.

The financial risks are substantial. Companies face the challenge of balancing the need to invest in a potentially transformative technology with the risk of overspending and creating stranded assets.

Meta's CEO has acknowledged the potential for wasted investment but emphasized the greater risk of falling behind if productive AI usage gains traction.

The financing of data centre construction and GPU purchases is increasingly reliant on Wall Street. Companies are utilizing both traditional and non-traditional financing methods to raise capital.

Innovative financing strategies, such as securitizing leasing revenue from data centres, are also being employed to fuel the boom. This approach allows developers to recycle capital into new projects, even if demand for existing data centre capacity begins to decline.

Even Silicon Valley companies themselves are contributing to the financing of the AI infrastructure boom. These circular investments highlight both the scale and the potential risks of the AI infrastructure bet. If the hype surrounding AI proves to be unsustainable, the interlocking investments could amplify any negative consequences.

Even proponents of AI acknowledge the significant financial challenges involved. The industry faces a daunting task in justifying the enormous investments being made in AI infrastructure.

No comments:

Post a Comment