Bitcoin and cryptocurrency have rapidly moved from niche concepts to mainstream discussions, capturing the attention of investors, tech enthusiasts, and the general public alike. For Americans just beginning to explore this digital frontier, understanding the basics is crucial before diving into the often-complex world of blockchain, wallets, and exchanges. This guide provides a foundational overview of Bitcoin and cryptocurrency, specifically tailored for beginners in the United States.

What is Cryptocurrency?

Cryptocurrency is a digital or virtual form of currency that uses cryptography for security. Unlike traditional currencies issued by central banks (like the US dollar), cryptocurrencies typically operate on decentralized technologies, most notably blockchain. This decentralization means that no single entity controls the cryptocurrency network, making it resistant to censorship and single points of failure. Cryptocurrencies aim to provide secure and transparent transactions, although their value can be highly volatile.

Understanding the fundamental concepts behind cryptocurrency involves grasping the basics of cryptography and distributed ledger technology. Cryptography secures the transactions and controls the creation of new units, while the distributed ledger, or blockchain, records every transaction in a public, immutable manner. This combination allows for a system where trust is built into the technology, rather than relying on intermediaries like banks.

Bitcoin: The Pioneer Cryptocurrency

Bitcoin, created in 2009 by an anonymous entity known as Satoshi Nakamoto, was the first decentralized cryptocurrency. It introduced the world to the concept of blockchain technology and demonstrated the potential for a peer-to-peer electronic cash system. Bitcoin's limited supply of 21 million coins is a key feature, designed to create scarcity and potentially drive long-term value.

Bitcoin transactions are recorded on a public ledger called the Bitcoin blockchain. Miners verify these transactions by solving complex cryptographic puzzles, a process known as "proof-of-work." In return for their efforts, miners are rewarded with newly minted Bitcoins, incentivizing them to maintain the network's integrity. The price of Bitcoin is determined by supply and demand on cryptocurrency exchanges around the world.

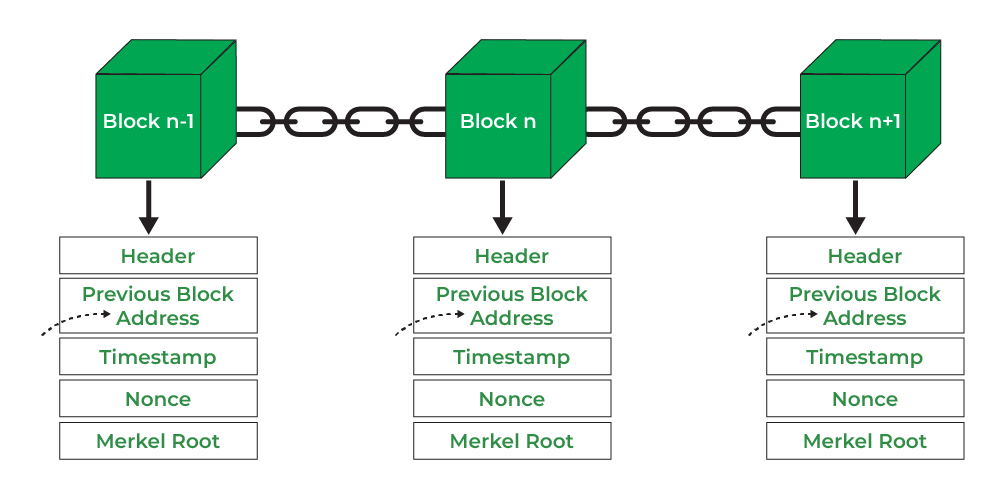

Understanding Blockchain Technology

Blockchain is the underlying technology that powers most cryptocurrencies, including Bitcoin. It is essentially a distributed, decentralized, public ledger that records transactions across many computers. Each block in the chain contains a set of transactions, and once a block is added to the chain, it cannot be altered, making the blockchain highly secure and transparent.

The immutability and transparency of blockchain technology have applications far beyond cryptocurrencies. It can be used for supply chain management, voting systems, healthcare records, and more. The ability to track and verify data securely and transparently is a major advantage of blockchain, making it a potentially disruptive technology across various industries.

Cryptocurrency Wallets: Your Digital Vault

A cryptocurrency wallet is a digital tool used to store, send, and receive cryptocurrencies. There are several types of wallets, each with varying levels of security and convenience:

-

Hardware Wallets: These are physical devices that store your private keys offline, providing the highest level of security against hacking.

2. Software Wallets: These are applications that can be installed on your computer or smartphone. They offer a balance between security and convenience.

3. Web Wallets: These are accessed through a web browser and are typically offered by cryptocurrency exchanges. While convenient, they are generally considered less secure than hardware or software wallets.

3. Web Wallets: These are accessed through a web browser and are typically offered by cryptocurrency exchanges. While convenient, they are generally considered less secure than hardware or software wallets. 4. Paper Wallets: This involves printing your private and public keys on a piece of paper and storing it in a safe place. This method is considered very secure if implemented correctly, but it requires careful handling.

4. Paper Wallets: This involves printing your private and public keys on a piece of paper and storing it in a safe place. This method is considered very secure if implemented correctly, but it requires careful handling.

Choosing the right wallet depends on your individual needs and risk tolerance. For long-term storage of large amounts of cryptocurrency, a hardware wallet is generally recommended. For smaller amounts and frequent transactions, a software wallet may be more convenient. Regardless of the type of wallet you choose, it is crucial to protect your private keys, as they are essential for accessing and controlling your cryptocurrency.

Cryptocurrency Exchanges: Where to Buy and Sell

Cryptocurrency exchanges are online platforms where you can buy, sell, and trade cryptocurrencies. They act as intermediaries between buyers and sellers, facilitating the exchange of cryptocurrencies for fiat currencies (like US dollars) or other cryptocurrencies. Popular exchanges in the United States include Coinbase, Kraken, Binance.US, and Gemini.

When choosing an exchange, consider factors such as security, fees, supported cryptocurrencies, and user interface. It is also important to be aware of the regulations and compliance requirements in your state, as some exchanges may not be available in all areas of the United States. Before using an exchange, research its security measures and read reviews from other users.

Buying Your First Cryptocurrency

The process of buying cryptocurrency typically involves the following steps:

- Choose an Exchange: Research and select a reputable cryptocurrency exchange that operates in the United States.

- Create an Account: Sign up for an account on the exchange and complete the verification process, which usually involves providing personal information and uploading identification documents.

- Deposit Funds: Deposit funds into your exchange account using a supported payment method, such as a bank transfer, debit card, or credit card.

- Place an Order: Once your funds have been deposited, you can place an order to buy cryptocurrency. You can choose to buy at the current market price (a "market order") or set a specific price at which you want to buy (a "limit order").

-

Secure Your Cryptocurrency: After purchasing cryptocurrency, it is highly recommended to transfer it from the exchange to a more secure wallet, such as a hardware or software wallet, to protect it from potential hacks or theft.

It's crucial to start small when buying cryptocurrency for the first time. Begin with an amount you are comfortable potentially losing, as the cryptocurrency market can be highly volatile. As you gain experience and knowledge, you can gradually increase your investment amount.

Risks and Considerations

Investing in cryptocurrencies involves significant risks, including:

-

Volatility: Cryptocurrency prices can fluctuate dramatically in short periods, leading to substantial gains or losses.

-

Security Risks: Cryptocurrency exchanges and wallets are potential targets for hackers, and there is a risk of losing your cryptocurrency due to theft or fraud.

-

Regulatory Uncertainty: The regulatory landscape for cryptocurrencies is still evolving, and future regulations could negatively impact the value or use of cryptocurrencies.

-

Complexity: Understanding the technical aspects of cryptocurrencies and blockchain technology can be challenging for beginners.

Before investing in cryptocurrencies, it is essential to do your own research and understand the risks involved. Only invest what you can afford to lose and diversify your investments to reduce your overall risk.

Cryptocurrency Taxation in the United States

The Internal Revenue Service (IRS) treats cryptocurrency as property, which means that cryptocurrency transactions are subject to capital gains taxes. When you sell, trade, or otherwise dispose of cryptocurrency, you may owe taxes on any profit you make.

It is important to keep accurate records of all your cryptocurrency transactions, including the date of purchase, the purchase price, the date of sale, and the sale price. You will need this information to calculate your capital gains or losses when filing your taxes. The IRS has increased its scrutiny of cryptocurrency transactions in recent years, so it is important to comply with all tax laws and regulations. Consult with a qualified tax professional for personalized advice on cryptocurrency taxation.

The Future of Bitcoin and Cryptocurrency

The future of Bitcoin and cryptocurrency is uncertain, but there is growing optimism about its potential to transform the financial system and various other industries. Bitcoin's limited supply and decentralized nature make it an attractive store of value for some investors, while other cryptocurrencies are focused on specific use cases, such as decentralized finance (DeFi), non-fungible tokens (NFTs), and smart contracts.

As the cryptocurrency industry continues to evolve, it is important to stay informed about the latest developments and trends. The information in this guide provides a solid foundation for understanding Bitcoin and cryptocurrency, but it is just the beginning of a journey into this exciting and rapidly changing world. Continuous learning and careful risk management are essential for navigating the opportunities and challenges of the cryptocurrency market.

No comments:

Post a Comment