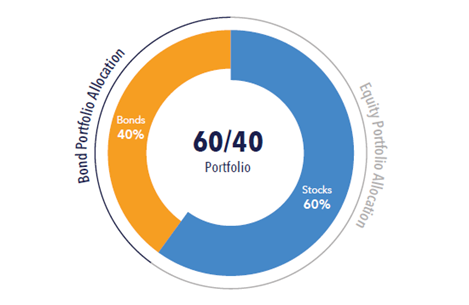

A seismic shift is underway in the world of finance, challenging decades-old investment strategies and heralding a new era for precious metals. For years, the 60/40 portfolio – 60% stocks and 40% bonds – reigned supreme as the gold standard for asset allocation. But now, influential voices are advocating for a diversification that includes a significant allocation to precious metals, particularly gold. This represents a dramatic departure from the past, with potentially significant implications for investors worldwide.

The End of the 60/40 Era

The long-standing dominance of the 60/40 portfolio is being questioned as major financial institutions and investment gurus recognize the changing landscape. Historically, this allocation strategy was favored for its balance between growth (stocks) and stability (bonds). However, current market conditions, including inflation concerns and geopolitical uncertainties, are prompting a reassessment of its efficacy.

Wall Street's New Mantra: Diversification with Gold

Mike Wilson, Chief Investment Officer at Morgan Stanley, is a prominent voice advocating for a revised investment strategy. He proposes a 60/20/20 allocation, suggesting that investors allocate 60% to stocks, 20% to bonds, and 20% to precious metals. This shift reflects a growing recognition of gold's potential as a hedge against economic instability and currency devaluation. It also underscores that gold is no longer considered an archaic investment.

The Bond King's Bold Prediction: A 25/25/25/25 Portfolio

Jeff Gundlach, the renowned "Bond King," is taking an even bolder stance, advocating for a 25/25/25/25 portfolio. This allocation suggests dividing investments equally among stocks, bonds, precious metals, and cash. The fact that a bond fund manager is actively encouraging investors to allocate a quarter of their portfolio to gold further emphasizes the changing sentiment towards precious metals. This diversification strategy aims to provide a more robust defense against market volatility and inflation.

From Relic to Respectable Asset: Gold's Transformation

For decades, gold was often dismissed as an outdated investment, an unproductive asset that merely "sits there," as famously stated by Warren Buffett. Financial advisors often viewed gold enthusiasts with suspicion. However, this perception is rapidly changing. The endorsement of gold by major financial firms and legendary investors signals a seismic shift in its perceived legitimacy. This newfound acceptance is expected to channel billions of dollars into the gold sector.

The Untapped Potential of the Gold Market

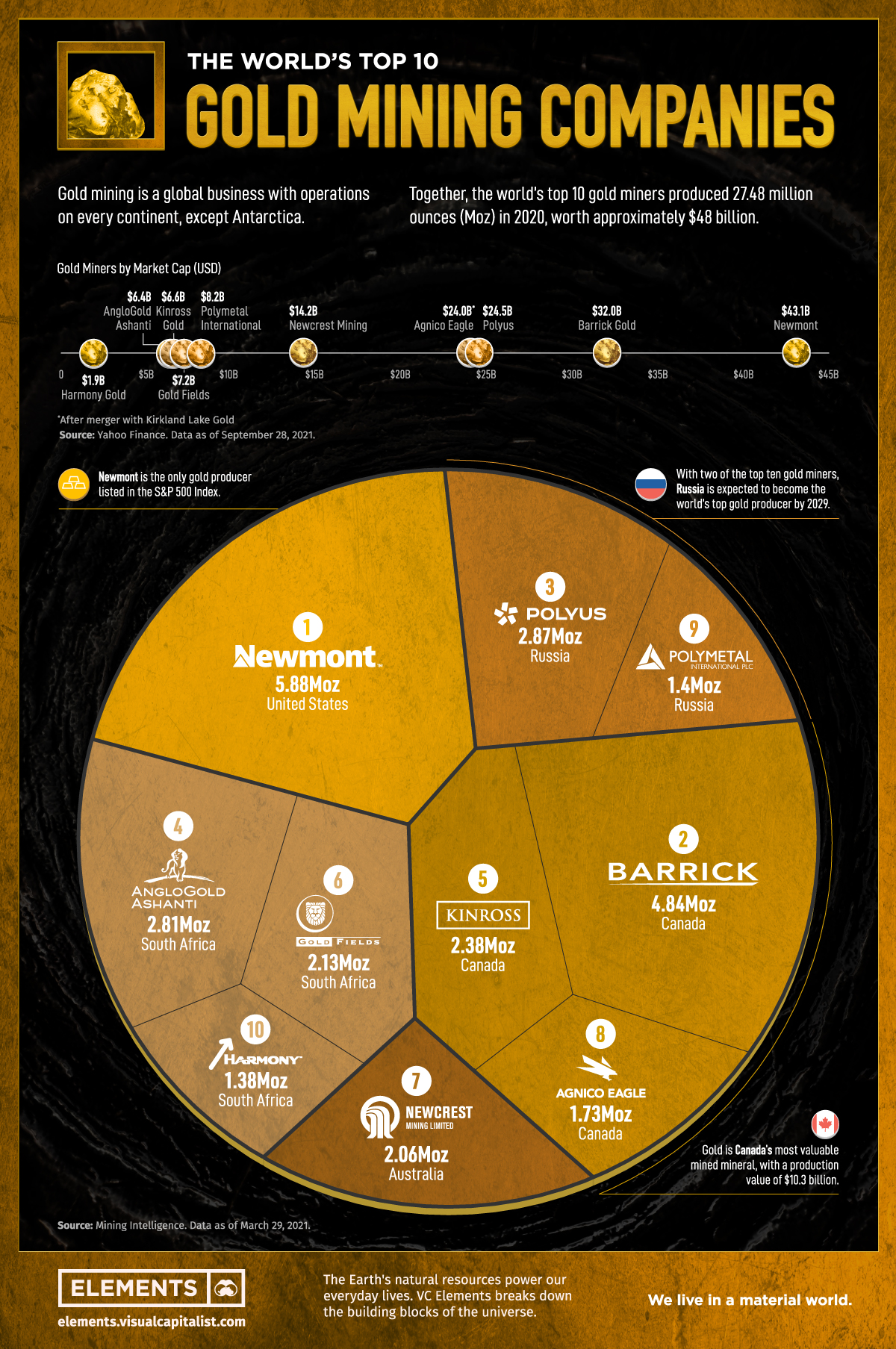

The relatively small size of the gold market presents a significant opportunity for growth. The annual global gold bullion market is estimated at approximately $60 billion, while the combined market capitalization of all U.S.-traded gold mining stocks is around $600 billion. Compared to other asset classes, the gold market has enormous potential. As major financial institutions begin recommending gold to their clients, the increased demand could drive prices significantly higher and sustain a prolonged bull market.

Ride the Inflationary Wave: Strategic Gold Investments

As inflation continues to pose a threat to the global economy, strategic investments in gold and gold mining companies can provide a hedge against its corrosive effects. Identifying promising gold mining plays is crucial for capitalizing on the current market environment. Investing in gold mining stocks can offer substantial returns, especially if these companies are well-managed and possess significant resources.

Understanding Gold's Safe-Haven Status

Gold is often considered a safe-haven asset due to its tendency to perform differently than stocks, bonds, and currencies. During periods of economic uncertainty, geopolitical instability, or stock market downturns, investors often flock to gold as a store of value. This demand can drive up gold prices, making it a valuable portfolio diversifier and a hedge against risk.

Key Considerations Before Investing in Gold

Before investing in gold, it's essential to understand the nuances of the market and carefully consider various factors.

- Define Your Goals: Determine whether you're seeking inflation protection, diversification, a safe haven, or simply speculation.

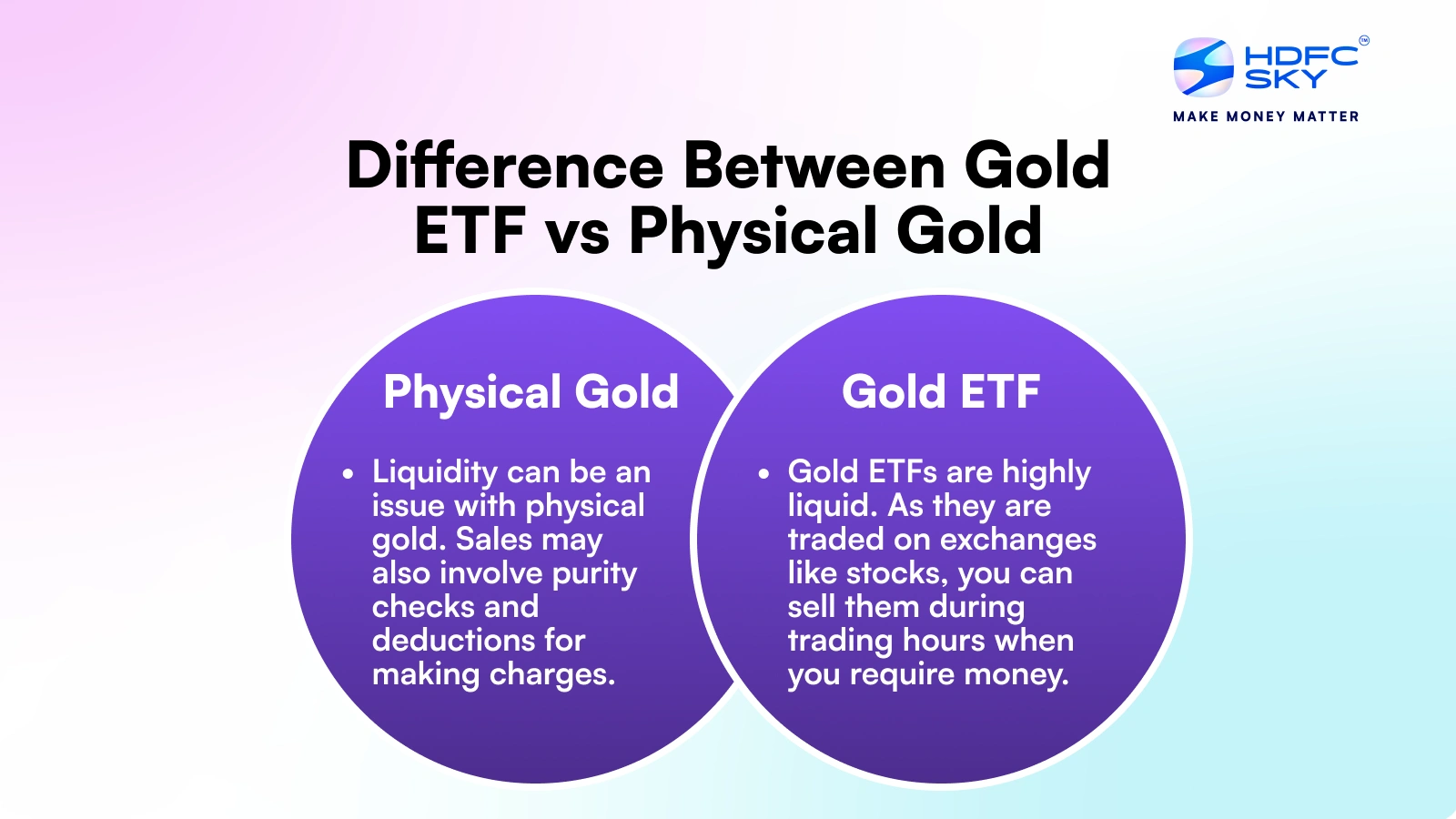

- Explore Different Investment Options: Consider physical gold, mining stocks, exchange-traded funds (ETFs), or futures contracts.

- Understand the Risks: Be aware of the volatility of gold prices and the potential for losses.

Navigating the Gold Market: Key Insights for Investors

Here are ten crucial points to consider before investing in gold:

- Gold Can Move Unpredictably: Gold's price can decline during equity sell-offs as investors sell gold to cover margin calls.

- Gold Prices Are Volatile: Despite its safe-haven status, gold is still subject to price fluctuations.

- Gold Stocks Are Not Equivalent to Physical Gold: Mining company share prices are influenced by factors beyond gold prices.

- Gold Futures Are High-Risk: Futures contracts require constant monitoring and understanding of margin and leverage.

- Physical Gold Extends Beyond Bars: Bullion includes bars, coins, and rounds.

- Premiums Apply to Physical Gold Purchases: Gold coins generally carry higher premiums than gold bars.

- Secure Storage is Essential for Physical Gold: Consider secure storage options, whether at home or with a third party.

- Physical Gold is Taxed as a Collectible: Profits on physical gold held for over a year are taxed at a higher rate.

- Gold Can Be Allocated or Unallocated: Understand the differences between allocated and unallocated gold accounts.

- Opportunity Cost Exists with Holding Gold: Weigh the potential returns of gold against other investment opportunities.

The Evolving Landscape: Gold's Continued Ascent

Gold prices have recently surged to record highs, driven by inflation concerns, geopolitical tensions, and expectations of future interest rate cuts. Spot gold has surpassed $3,700 per ounce, marking significant gains this year. Continued purchases by global central banks and ongoing geopolitical strife are expected to support demand for precious metals.

Investment Strategies: Embracing Gold in a Diversified Portfolio

Experts recommend gaining exposure to gold through exchange-traded funds (ETFs) that track the price of physical gold. Gold ETFs offer liquidity, tax efficiency, and low costs compared to owning physical gold. Some popular gold ETFs include SPDR Gold Shares (GLD) and iShares Gold Trust (IAU). As Blair duQuesnay, a chartered financial analyst and certified financial planner, notes, "Gold ETFs are going to be the most liquid, tax-efficient, and low-cost way to invest in gold."

The embrace of precious metals by financial titans signals a fundamental shift in investment thinking. Gold, once relegated to the sidelines, is now taking center stage as a valuable asset in a well-diversified portfolio. As investors navigate an uncertain economic landscape, understanding the role of gold and strategically allocating capital to this precious metal could prove to be a golden opportunity.

No comments:

Post a Comment