Electronic Arts (EA), a global leader in interactive entertainment, presents a compelling investment opportunity for individuals worldwide. Understanding the intricacies of EA stock, its performance, and future potential is crucial for making informed investment decisions. This guide provides a comprehensive overview for global investors considering adding EA to their portfolio.

Understanding Electronic Arts and its Market Position

Electronic Arts (EA) is more than just a video game company; it's a diverse entertainment giant that develops, markets, publishes, and distributes games and related content globally. The company boasts a portfolio of iconic franchises, including FIFA (now EA Sports FC), Madden NFL, Battlefield, The Sims, Apex Legends, and many more. EA operates across various platforms, including consoles, PCs, and mobile devices, catering to a broad audience and solidifying its position as a market leader. The company's strength lies not only in its established franchises but also in its ability to innovate and develop new intellectual properties (IPs) that capture the attention of the gaming community. Furthermore, EA's shift towards digital distribution and live services has created recurring revenue streams, enhancing its financial stability and attractiveness to investors.

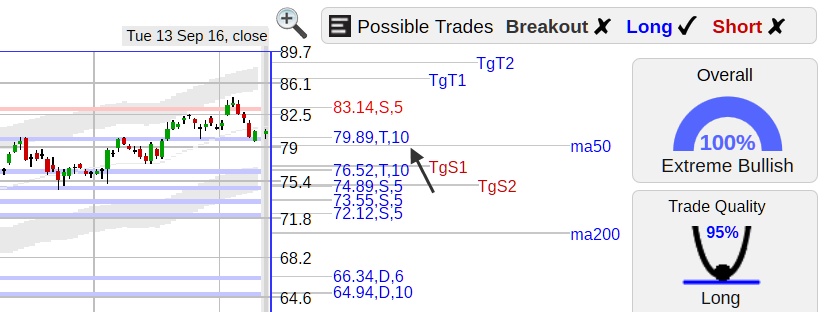

EA Stock Performance: A Historical Overview

Analyzing the historical performance of EA stock (NASDAQ: EA) provides valuable insights into its growth trajectory and potential for future returns. Over the past decade, EA stock has generally demonstrated strong growth, driven by the increasing popularity of video games, the success of its key franchises, and the company's effective monetization strategies. However, like any stock, EA's share price has experienced fluctuations due to various factors, including broader market trends, economic conditions, and company-specific events, such as game releases, acquisitions, and competitive pressures. Examining key financial metrics, such as revenue growth, earnings per share (EPS), and price-to-earnings (P/E) ratio, helps investors assess EA's financial health and compare it to its peers in the gaming industry. Moreover, understanding the impact of major game releases and industry trends on EA's stock performance is essential for making informed investment decisions. A review of the stock's performance during different economic cycles can also provide valuable context for long-term investment strategies.

Key Factors Influencing EA Stock

Several factors significantly influence the performance of EA stock. These include:

-

Game Releases and Performance: The success of new game releases is a primary driver of EA's revenue and stock performance. Positive reviews, strong sales figures, and high player engagement can significantly boost investor confidence and drive up the stock price. Conversely, negative reviews, disappointing sales, or technical issues can negatively impact the stock.

-

Digital Distribution and Live Services: EA's increasing focus on digital distribution and live services has created a more predictable and recurring revenue stream. Live services, such as in-game purchases and subscriptions, provide ongoing revenue generation beyond the initial game sale, contributing to the company's financial stability.

-

Industry Trends: The gaming industry is constantly evolving, with new technologies and trends emerging regularly. Factors such as the rise of mobile gaming, esports, cloud gaming, and virtual reality (VR) can significantly impact EA's business and stock performance. Adapting to these trends and investing in new technologies is crucial for EA's long-term success.

-

Competition: The gaming industry is highly competitive, with numerous companies vying for market share. EA faces competition from other major publishers, such as Activision Blizzard, Take-Two Interactive, and Ubisoft, as well as smaller independent developers. The competitive landscape can impact EA's market share, pricing power, and profitability.

-

Economic Conditions: Broader economic conditions can also influence EA's stock performance. During economic downturns, consumer spending on discretionary items, such as video games, may decline, impacting EA's revenue and profitability. Conversely, during periods of economic growth, consumer spending may increase, boosting EA's sales.

EA's Strategic Initiatives and Future Growth Prospects

EA has implemented several strategic initiatives to drive future growth and enhance shareholder value. These include:

-

Investing in New Technologies: EA is actively investing in new technologies, such as cloud gaming and artificial intelligence (AI), to enhance its game development capabilities and expand its reach to new platforms. These investments are aimed at creating more immersive and engaging gaming experiences for players.

-

Expanding into New Markets: EA is focused on expanding its presence in emerging markets, such as Asia and Latin America, where the gaming industry is experiencing rapid growth. These markets offer significant opportunities for EA to reach new players and increase its revenue.

-

Developing New IPs: While EA relies heavily on its established franchises, the company is also investing in the development of new IPs to diversify its portfolio and attract new audiences. Successful new IPs can provide a significant boost to EA's revenue and stock performance.

-

Acquisitions: EA has a history of acquiring smaller game studios and technologies to expand its capabilities and strengthen its competitive position. Strategic acquisitions can provide EA with access to new talent, technologies, and IPs.

Risks and Challenges for EA Stock

Investing in EA stock, like any investment, involves certain risks and challenges. These include:

-

Dependence on Hit Titles: EA's financial performance is heavily dependent on the success of a few key franchises. A failure to deliver successful new iterations of these franchises could significantly impact the company's revenue and profitability.

-

Development Costs: The cost of developing AAA video games is constantly increasing, requiring significant investment from EA. Cost overruns or delays in game development can negatively impact the company's financial performance.

-

Competition: The gaming industry is highly competitive, with numerous companies vying for market share. EA faces competition from established players as well as new entrants, which could impact its market share and profitability.

-

Changing Consumer Preferences: Consumer preferences in the gaming industry are constantly evolving. EA must adapt to these changes and develop games that appeal to a broad audience. Failure to do so could result in declining sales and market share.

-

Regulatory Risks: The gaming industry is subject to increasing regulatory scrutiny, particularly regarding issues such as loot boxes and data privacy. New regulations could impact EA's business model and profitability.

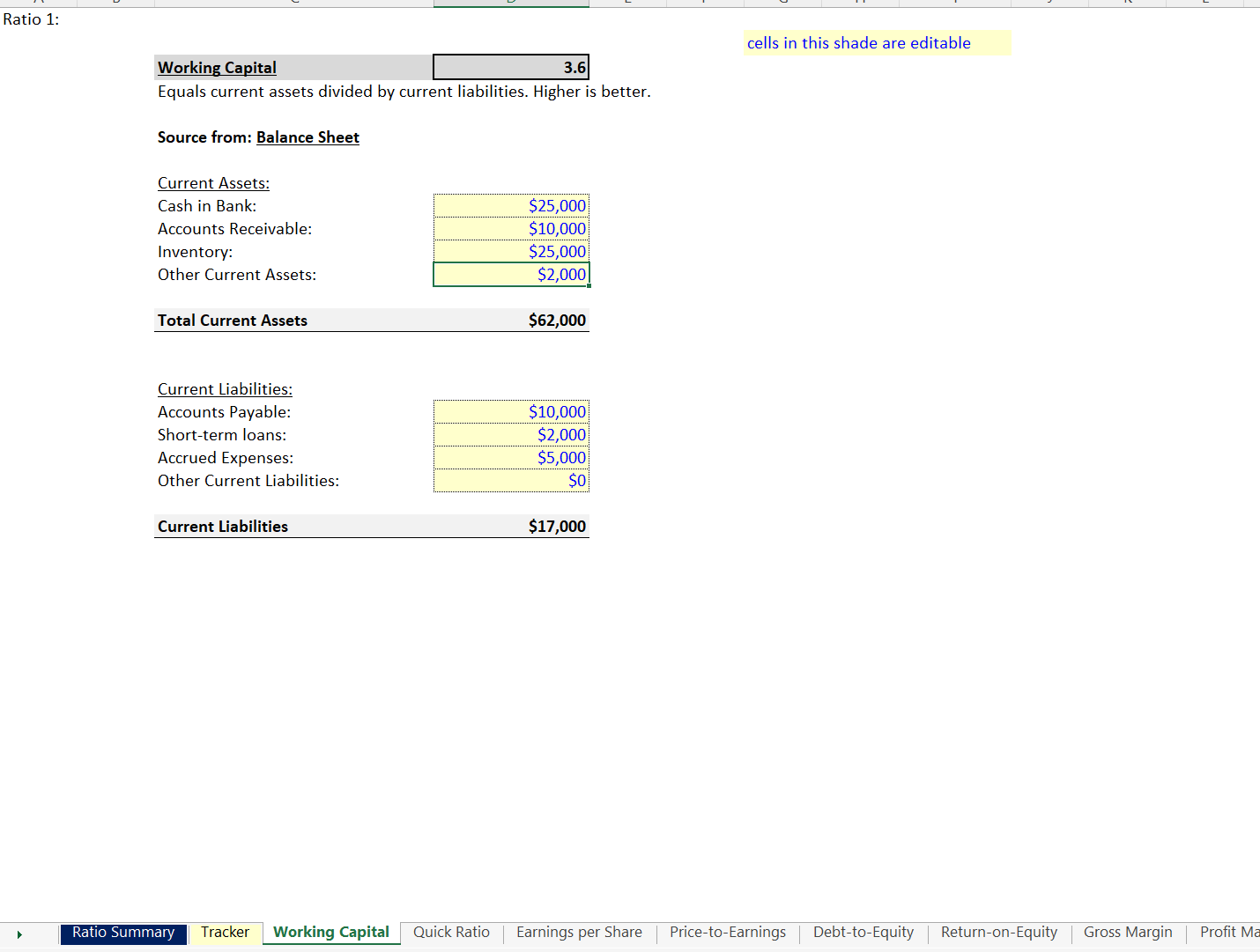

Financial Analysis and Valuation of EA Stock

Conducting a thorough financial analysis is crucial for determining the fair value of EA stock. This involves examining key financial metrics, such as revenue growth, profitability, cash flow, and debt levels. Comparing EA's financial performance to its peers in the gaming industry can provide valuable insights into its relative strengths and weaknesses. Additionally, using valuation methods, such as discounted cash flow (DCF) analysis and relative valuation, can help investors estimate the intrinsic value of EA stock. Understanding the assumptions underlying these valuation methods is essential for making informed investment decisions. Analysts' ratings and price targets for EA stock can also provide valuable perspectives, but investors should conduct their own independent research and analysis.

Investing in EA Stock: A Global Perspective

For global investors, investing in EA stock offers exposure to the global gaming market. However, there are several considerations to keep in mind. Currency exchange rates can impact the returns on EA stock for investors outside of the United States. Political and economic conditions in different regions can also affect EA's business and stock performance. Understanding the tax implications of investing in EA stock in different countries is also essential. Global investors should consult with a financial advisor to determine the best way to invest in EA stock based on their individual circumstances.

Conclusion: Is EA Stock a Good Investment?

Whether EA stock is a good investment depends on individual investment goals, risk tolerance, and time horizon. EA is a well-established company with a strong portfolio of franchises and a solid track record of growth. However, the gaming industry is constantly evolving, and EA faces certain risks and challenges. Investors should conduct thorough research and analysis before investing in EA stock, considering both the potential rewards and the potential risks. A diversified investment portfolio is generally recommended to mitigate risk. Monitoring EA's financial performance, industry trends, and competitive landscape is crucial for making informed investment decisions over the long term.

No comments:

Post a Comment