The gaming world is abuzz with speculation and analysis following Electronic Arts' (EA) recent strategic moves, prompting many to question whether a complete buyout is on the horizon. While EA remains a powerhouse, the landscape is shifting, and the possibility of a major acquisition is no longer relegated to the realm of rumor. This article delves into the factors driving this speculation, potential suitors, and the implications for the future of gaming.

EA's Evolving Position in the Market

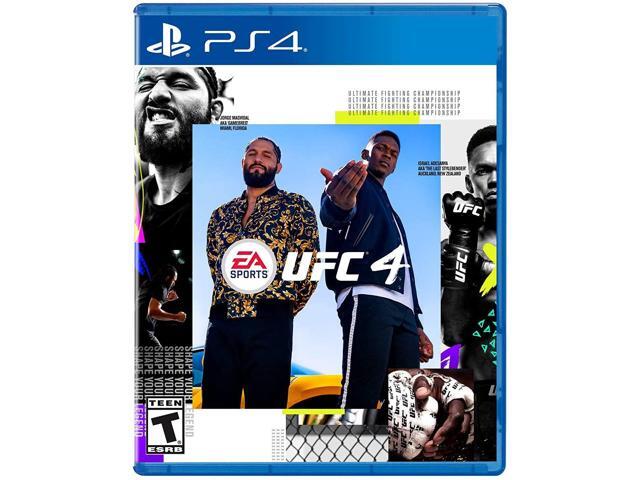

EA has long been a dominant force, boasting a portfolio of blockbuster franchises like FIFA (now EA Sports FC), Madden NFL, Battlefield, Apex Legends, and The Sims. However, the company has faced increasing scrutiny over its monetization strategies, perceived lack of innovation in some franchises, and controversies surrounding workplace culture. While revenue remains substantial, driven by live service models, subscription services like EA Play, and annual sports titles, there's a sense that EA needs a refresh to maintain its competitive edge in an increasingly dynamic market. The rise of cloud gaming, the metaverse, and new distribution platforms are forcing all major players to re-evaluate their strategies. Furthermore, other companies have been making strong movements, such as Microsoft acquiring Activision Blizzard. This significantly changes the dynamics of the market and puts pressure on EA to adapt.

Factors Fueling Buyout Speculation

Several key factors are contributing to the ongoing buyout discussions:

-

Market Consolidation: The gaming industry is undergoing a period of intense consolidation. Microsoft's acquisition of Activision Blizzard, Take-Two Interactive's purchase of Zynga, and Sony's acquisition of Bungie are just a few examples of the large-scale mergers and acquisitions reshaping the competitive landscape. EA, with its valuable IP and established player base, becomes an attractive target in this environment.

-

Shifting Revenue Models: The industry's transition from traditional game sales to live service models, subscriptions, and microtransactions is impacting revenue streams and requiring companies to invest heavily in ongoing content creation and community management. A larger entity with deeper pockets might be better positioned to navigate these evolving business models.

-

Technological Disruption: Cloud gaming, the metaverse, and blockchain-based gaming are presenting both opportunities and challenges. Developing and adapting to these new technologies requires significant investment and expertise. An acquisition by a tech giant could provide EA with access to the resources and infrastructure needed to compete in these emerging areas.

-

Investor Pressure: Shareholders are constantly evaluating a company's performance and potential for growth. If investors perceive that EA is underperforming or lacking a clear strategic vision for the future, they may become more receptive to the idea of a buyout.

-

Strategic Partnerships: EA has been actively pursuing strategic partnerships with other companies in areas like streaming and esports. These partnerships, while beneficial, could also be interpreted as a precursor to a larger deal, as EA seeks to integrate its offerings into a broader ecosystem.

Potential Suitors

Several companies have been identified as potential acquirers of EA, each bringing a unique set of strengths and strategic objectives:

-

Microsoft: Following the Activision Blizzard acquisition, Microsoft has demonstrated a clear commitment to expanding its gaming footprint. Acquiring EA would significantly bolster its Game Pass offering, add valuable IP to its portfolio, and strengthen its position in the sports game market. Microsoft's cloud gaming infrastructure and metaverse ambitions also align well with EA's potential for growth in these areas.

- Microsoft's financial strength makes them a credible bidder.

- Their Xbox Game Pass ecosystem would be greatly enhanced by EA's titles.

- Concerns about antitrust scrutiny following the Activision Blizzard deal could present a hurdle.

-

Sony: As a direct competitor to Microsoft in the console market, Sony could view acquiring EA as a defensive move to prevent Microsoft from gaining an insurmountable advantage. EA's sports franchises and established development studios would complement Sony's existing portfolio and enhance its PlayStation ecosystem.

- Sony's established presence in the gaming market makes them a logical contender.

- Acquiring EA would provide exclusive content for the PlayStation platform.

- Financial constraints compared to Microsoft could limit their ability to make a competitive offer.

-

Amazon: Amazon has been investing heavily in gaming through its Amazon Games studio and its Twitch streaming platform. Acquiring EA would provide Amazon with a catalog of established franchises and a wealth of development talent, accelerating its efforts to become a major player in the gaming industry.

- Amazon's vast resources and cloud infrastructure could greatly benefit EA.

- They have the resources to invest in new and upcoming games.

- Their track record in gaming development has been mixed, raising questions about their ability to effectively manage EA.

-

Tencent: The Chinese tech giant Tencent already owns stakes in several major gaming companies, including Riot Games (League of Legends) and Epic Games (Fortnite). Acquiring EA would further solidify Tencent's position as the world's largest gaming company and give it access to a wider range of Western markets and IP. However, regulatory hurdles and political concerns could complicate such a deal.

- Tencent has a proven track record of success in the gaming industry.

- Their global reach would expand EA's market presence.

- Regulatory concerns and political sensitivities could present significant obstacles.

-

Apple: Apple has been making a push into gaming with Apple Arcade and its efforts to optimize its devices for gaming. Acquiring EA would provide Apple with exclusive content for its platforms and strengthen its position in the mobile gaming market.

- Apple's focus on quality and user experience aligns well with EA's brand.

- Acquiring EA would add valuable content to Apple Arcade.

- Apple's limited experience in traditional console and PC gaming could be a disadvantage.

Implications for the Gaming World

A buyout of EA would have significant implications for the gaming world, impacting players, developers, and the industry as a whole:

-

Content Exclusivity: Depending on the acquirer, some EA titles could become exclusive to a particular platform or subscription service. This could limit player choice and create further fragmentation in the market. For example, if acquired by Microsoft, games could become exclusive to the Xbox ecosystem and Game Pass.

-

Changes in Monetization: The acquirer's philosophy on monetization could influence how EA's games are priced and how microtransactions are implemented. A change in ownership could lead to more or less aggressive monetization strategies, depending on the acquirer's priorities.

-

Impact on Development Studios: A buyout could lead to restructuring and layoffs within EA's development studios. The acquirer might prioritize certain franchises or development teams over others, potentially leading to the closure of some studios or the departure of key personnel.

-

Innovation and Investment: A new owner could inject fresh capital and resources into EA, leading to increased investment in new technologies and innovative game development. Alternatively, a focus on maximizing profits could stifle creativity and lead to a decline in the quality of EA's games.

-

Competition and Market Dynamics: A buyout could further consolidate the gaming industry and reduce competition. A smaller number of large companies controlling a larger share of the market could lead to higher prices, less innovation, and less choice for consumers.

The Future of EA

The question of whether EA will be acquired remains open. While the factors driving buyout speculation are compelling, EA also has the potential to remain independent and navigate the evolving gaming landscape on its own terms. The company has been investing in new technologies, exploring new business models, and working to improve its reputation among players.

If EA chooses to remain independent, it will need to address several key challenges:

- Improving Game Quality: EA needs to focus on delivering high-quality games that meet the expectations of players. This requires investing in development talent, fostering a creative work environment, and listening to feedback from the community.

- Re-evaluating Monetization Strategies: EA needs to find a balance between generating revenue and providing a fair and enjoyable experience for players. This may involve reducing the reliance on microtransactions, offering more value in subscription services, and experimenting with alternative monetization models.

- Adapting to New Technologies: EA needs to embrace new technologies like cloud gaming, the metaverse, and blockchain-based gaming. This requires investing in research and development, partnering with other companies, and experimenting with new game concepts.

- Strengthening its Brand: EA needs to rebuild its reputation among players and address concerns about workplace culture. This requires transparency, accountability, and a commitment to creating a positive and inclusive environment for both employees and players.

Regardless of whether EA is acquired or remains independent, the company faces a critical juncture in its history. The decisions it makes in the coming years will determine its future role in the gaming world. The potential buyout highlights the dynamic nature of the gaming market and the constant pressure on companies to adapt and innovate to stay ahead of the competition. The gaming community will be watching closely to see how this story unfolds.

No comments:

Post a Comment