Hydrogen's Promise and the Path to Reality: Examining Companies Navigating the Energy Transition

Hydrogen has been touted as a revolutionary energy source, poised to transform various sectors and drive significant growth in the stock market. However, recent developments suggest that the transition to a hydrogen economy faces practical challenges. A notable example is energy giant RWE's withdrawal from a substantial green hydrogen project in Namibia, citing weak demand in Europe. This decision highlights the gap between the envisioned hydrogen era and the current realities of implementation. Investors are increasingly turning their attention to transitional technologies that offer immediate solutions for emissions reduction. This article explores the strategies of three distinct companies – BMW, BASF, and dynaCERT – as they navigate the evolving landscape of energy transition.

BMW's Multi-Faceted Approach: Electric Mobility and Hydrogen Exploration

BMW, the renowned German automaker, is strategically prioritizing electric mobility. The company achieved a record delivery of 111,000 fully electric vehicles in the second quarter of 2025, demonstrating its commitment to this sector. However, BMW also emphasizes the importance of remaining open to all technological possibilities.

CEO Oliver Zipse has publicly stated that hydrogen is a crucial component of the energy transition, acting as a versatile energy carrier and a vital element for achieving emission-free mobility. He believes that a single technology alone cannot solve the complex challenges of decarbonization.

To explore the potential of hydrogen, BMW launched a pilot fleet of the iX5 Hydrogen in 2023. This initiative involved deploying approximately 100 hydrogen-powered SUVs for real-world testing and demonstration purposes across the globe. The successful completion of this test run has paved the way for BMW to consider commencing series production of hydrogen vehicles as early as 2028.

BMW's approach reflects a long-term strategy of developing expertise in various alternative drive systems alongside its expansion of electric mobility. This ensures that the company is well-prepared for future energy scenarios and can adapt to evolving market demands.

BASF's Green Hydrogen Integration: A Catalyst for Transformation

BASF, the world's leading chemical company, is also making significant strides in the hydrogen sector. Faced with rising energy prices, ambitious emission targets, and a historical reliance on imported fossil fuels, BASF has embarked on a comprehensive transformation process.

A key element of this transformation is the commissioning of a 54-megawatt electrolyser at its Ludwigshafen site. This plant, which was launched last March, is directly integrated into BASF's Verbund network and is projected to reduce CO₂ emissions by up to 72,000 tons annually.

The hydrogen produced at the Ludwigshafen facility replaces hydrogen previously derived from natural gas and is used in the production of essential chemicals such as ammonia and methanol. Furthermore, BASF plans to make surplus hydrogen available for mobility applications in the Rhine-Neckar region, actively promoting the development of a broader hydrogen economy.

BASF's commitment extends beyond its own operations. The company aims to leverage its expertise to support its partners in addressing the challenges of the future, fostering collaboration and innovation within the industry.

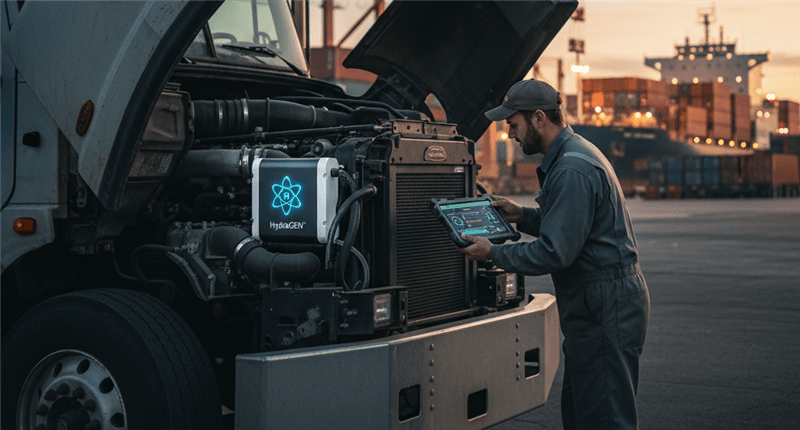

dynaCERT's Retrofit Solution: Bridging the Gap with Existing Diesel Engines

dynaCERT, a Canadian company founded in 2004, offers a unique hydrogen solution with broad applicability. Its HydraGEN™ retrofit kits are designed to be added to existing diesel engines, generating hydrogen and oxygen from distilled water and injecting them into the engine's air intake. This process reduces both fuel consumption and harmful emissions.

dynaCERT's target market includes operators of various diesel-powered vehicles and machinery, ranging from truck fleets to construction equipment, mining machines, trains, ships, and stationary generators. A notable feature of the HydraGEN™ system is its telematics software, which documents CO₂ savings during operation, potentially enabling the generation of valuable CO₂ certificates.

Under new management, dynaCERT has recently undergone a strategic repositioning, focusing on closer collaboration with industry partners. Recognizing that heavy commercial vehicles and industrial drives will continue to rely on combustion engines for the foreseeable future, dynaCERT positions HydraGEN™ as an immediate solution for reducing carbon footprints until alternative drive systems become widely available.

Furthermore, dynaCERT offers companies the opportunity to extend the lifespan of their existing machinery, postponing major investments in new equipment. This is particularly appealing in the current economic climate.

dynaCERT: Potential for Growth and Investment Considerations

dynaCERT recently announced a significant sales success, with a partner ordering 100 HydraGEN™ units for their inventory. If this order is followed by others, the company could scale up production and manufacture its technology on a larger scale.

Despite these positive developments, dynaCERT's share price has not yet reflected the company's recent successes, experiencing a decline of nearly 20% over the past six months.

For investors, dynaCERT represents a speculative investment opportunity with the potential for significant growth if the company can secure additional orders, particularly in the heavy machinery sector. With a current valuation of approximately EUR 40 million, dynaCERT could experience substantial gains in the stock market if its efforts prove successful.

Unlike the relatively stable shares of BMW and BASF, dynaCERT's stock is considered more speculative, offering the potential for rapid movement. While the investment carries higher risk, it also presents the possibility of significant returns if dynaCERT's hydrogen solution gains wider adoption.

No comments:

Post a Comment