Jared Kushner, former senior advisor to President Donald Trump and son-in-law, has transitioned from the political arena to the world of high finance and international deal-making. Since leaving the White House, Kushner has established himself as a prominent figure in private equity, leveraging his connections and experience to forge significant partnerships and investments, particularly in the technology and real estate sectors. His firm, Affinity Partners, has quickly become a player in major deals, drawing both attention and controversy. This article delves into Kushner's post-White House activities, examining his business ventures, strategic partnerships, and the influence he continues to wield on the global stage.

Affinity Partners: Building a Post-Political Empire

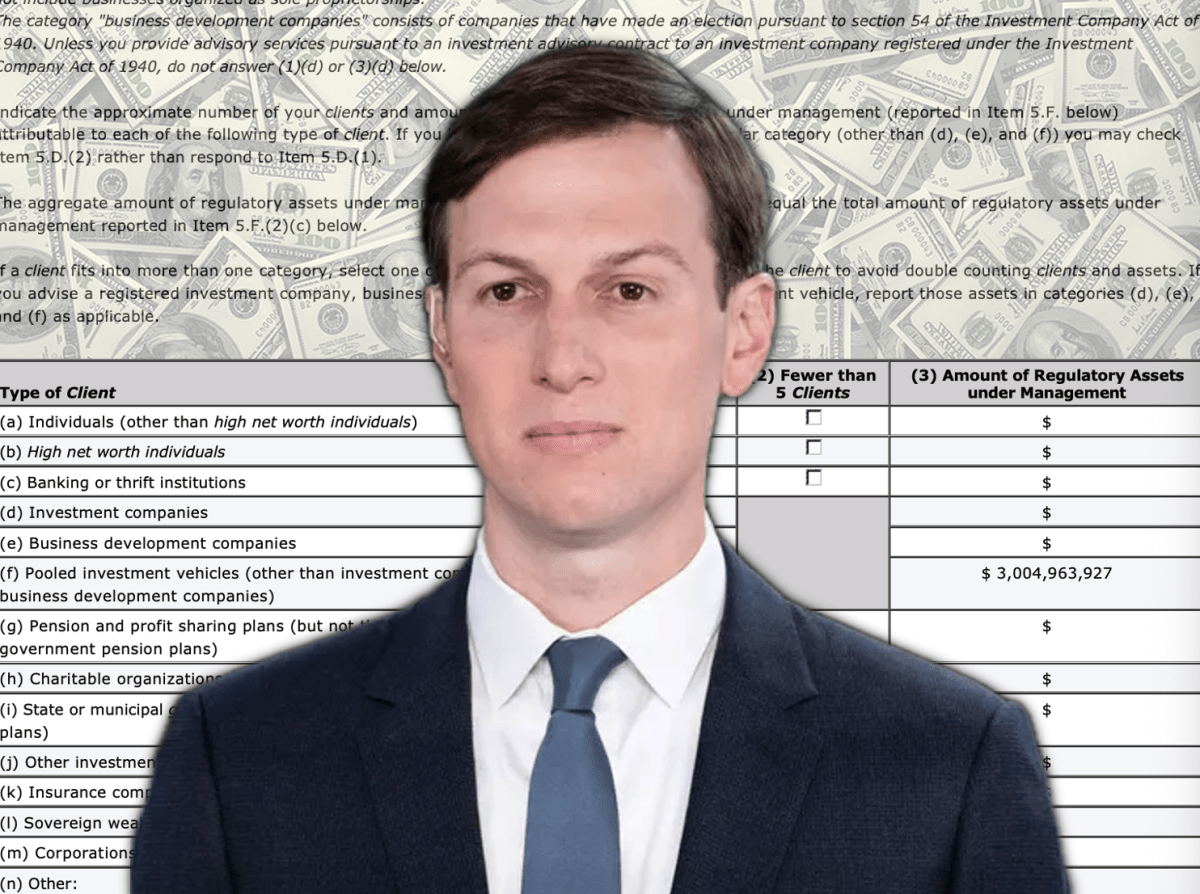

Following his tenure in the Trump administration, Jared Kushner founded Affinity Partners, a Miami-based private equity firm. This venture marked a significant shift in Kushner's career, moving from advising on national policy to actively shaping investment strategies. Affinity Partners quickly gained attention for its ambitious goals and high-profile deals, securing substantial funding and establishing itself as a notable player in the private equity landscape.

-

Formation and Funding: Affinity Partners was launched with the aim of investing in various sectors, including technology, real estate, and emerging markets. Crucially, the firm secured significant financial backing from sovereign wealth funds, particularly from Saudi Arabia's Public Investment Fund (PIF). This partnership has been instrumental in enabling Affinity Partners to pursue large-scale investments.

-

Investment Strategy: The firm's strategy focuses on identifying and capitalizing on opportunities in sectors poised for growth. Affinity Partners seeks to leverage its network and expertise to add value to its portfolio companies, aiming for long-term returns. Kushner's experience in the White House, where he was involved in negotiating international agreements and promoting economic development, has undoubtedly influenced his investment approach.

-

Controversies: The close ties between Affinity Partners and Saudi Arabia have raised concerns among some observers. Critics argue that Kushner's previous role in the government, coupled with the significant investment from the Saudi PIF, presents potential conflicts of interest. These concerns have led to scrutiny of Affinity Partners' deals and Kushner's overall business activities.

The Electronic Arts Deal: A Gaming Giant Acquisition

One of the most significant deals involving Affinity Partners is the proposed acquisition of Electronic Arts (EA), a video game giant known for franchises like FIFA, Madden NFL, and The Sims. This $55 billion deal, one of the largest private equity buyouts in history, highlights Kushner's growing influence in the tech and entertainment sectors.

-

Deal Structure: The acquisition involves a consortium led by Affinity Partners, alongside Saudi Arabia's PIF and Silver Lake Partners. The deal aims to take EA private, providing the company with greater flexibility to innovate and adapt to the rapidly changing gaming landscape.

-

Strategic Rationale: EA has faced challenges in recent years, including stagnant revenue growth and increasing competition from other game developers. By going private, EA can potentially pursue long-term strategies without the pressure of quarterly earnings reports. Kushner has expressed admiration for EA's ability to create iconic gaming experiences, emphasizing his personal connection to the company's products.

-

Regulatory Considerations: Given the involvement of foreign investors, particularly the Saudi PIF, the EA acquisition is subject to regulatory review by the Committee on Foreign Investment in the United States (CFIUS). Kushner's involvement is seen by some as potentially easing the deal's path through CFIUS, given his past relationships and understanding of the regulatory landscape.

Strategic Partnerships: Saudi Arabia and Beyond

A key aspect of Jared Kushner's post-White House success is his ability to forge strategic partnerships, particularly with entities in the Middle East. His close relationship with Saudi Arabia has been instrumental in securing funding for Affinity Partners and pursuing large-scale investment opportunities.

-

Saudi Arabia's Public Investment Fund (PIF): The Saudi PIF has emerged as a significant investor in Affinity Partners, providing billions of dollars in capital. This partnership reflects Saudi Arabia's broader ambition to diversify its economy and invest in technology and entertainment sectors. Kushner's ties to the Saudi leadership, cultivated during his time in the White House, have facilitated this collaboration.

-

Broader Middle Eastern Ties: In addition to Saudi Arabia, Kushner has cultivated relationships with other countries in the Middle East, including the United Arab Emirates (UAE) and Qatar. These relationships have opened doors for Affinity Partners to explore investment opportunities across the region.

-

Geopolitical Implications: Kushner's partnerships in the Middle East have geopolitical implications, as they align with broader efforts to promote economic cooperation and regional stability. However, these partnerships have also drawn scrutiny due to human rights concerns and the political complexities of the region.

The "Kushner-Blair Plan" and Post-War Gaza

Beyond his business ventures, Jared Kushner has also remained involved in efforts to address geopolitical challenges, particularly in the Middle East. Reports have emerged of a "Kushner-Blair plan" for post-war Gaza, involving an international advisory council and a committee of Palestinian technocrats to administer the territory.

-

The Board of Peace: The proposed plan envisions the creation of an international advisory council, potentially chaired by Donald Trump, to provide oversight to a committee of Palestinian technocrats. Former UK Prime Minister Tony Blair has also been involved in developing this plan.

-

Development Opportunities: The Kushner-affiliated vision for Gaza's future emphasizes development opportunities, with proposals for reconstruction and economic growth. However, these plans have faced criticism for their lack of Palestinian representation and concerns about forced displacement.

-

Controversies and Criticisms: The "Kushner-Blair plan" has drawn criticism from various quarters, including concerns about the lack of Palestinian input and the potential for exploitation of Gaza's resources. Critics argue that the plan prioritizes economic interests over the political rights and self-determination of the Palestinian people.

Ethical Considerations and Conflicts of Interest

Jared Kushner's transition from the White House to the world of private equity has raised ethical considerations and concerns about potential conflicts of interest. His close ties to foreign governments, particularly Saudi Arabia, have drawn scrutiny from watchdogs and government officials.

-

Sovereign Wealth Fund Investments: The significant investment from the Saudi PIF in Affinity Partners has raised questions about whether Kushner's previous role in the government influenced the fund's decision. Critics argue that Kushner's access to classified information and his relationships with foreign leaders could have provided an unfair advantage in securing this investment.

-

CFIUS Reviews: Kushner's involvement in deals involving foreign investors, such as the EA acquisition, has raised concerns about potential conflicts of interest in the CFIUS review process. While some argue that his presence could ease the path for such deals, others worry that it could undermine the integrity of the review process.

-

Transparency and Accountability: Calls for greater transparency and accountability in Kushner's business dealings have increased, with demands for more information about the sources of funding for Affinity Partners and the terms of its investments. Critics argue that the lack of transparency undermines public trust and raises questions about potential undue influence.

Kushner's Enduring Influence

Despite leaving the White House, Jared Kushner continues to exert influence in various spheres, from private equity and technology to international relations. His ability to forge strategic partnerships, navigate complex deals, and maintain relationships with key decision-makers underscores his enduring presence on the global stage.

-

Dealpolitik: Kushner's activities blur the lines between business and politics, reflecting a hybrid doctrine of "dealpolitik." His ability to leverage his political connections and experience to advance his business interests has raised questions about the ethical implications of this approach.

-

Legacy and Future: As Kushner continues to build his post-White House empire, his legacy will be shaped by the impact of his business ventures, his involvement in geopolitical initiatives, and the ethical considerations surrounding his activities. Whether he will continue to play a significant role in shaping policy and investment decisions remains to be seen.

-

Navigating Challenges: Kushner faces numerous challenges as he navigates the complex landscape of global finance and international relations. These challenges include managing potential conflicts of interest, addressing ethical concerns, and maintaining the trust of investors and stakeholders. His ability to overcome these challenges will determine the long-term success of his ventures.

No comments:

Post a Comment