Mizuho Financial Group, a prominent Japanese bank, has been strategically expanding its footprint in the United States, aiming to capitalize on the robust economic opportunities and solidify its position as a global financial powerhouse. This expansion represents a significant commitment to the US market, reflecting a long-term vision for growth and a recognition of the country's pivotal role in the global financial landscape. Mizuho's approach involves a multifaceted strategy, encompassing investment banking, commercial banking, and wealth management services, tailored to meet the diverse needs of its clients in the US.

A Strategic Expansion

Mizuho's expansion into the US market is not a recent phenomenon but rather a gradual and deliberate process that has been unfolding over several decades. Initially focusing on serving Japanese corporations with operations in the US, Mizuho has broadened its scope to cater to a wider range of clients, including multinational corporations, institutional investors, and high-net-worth individuals. This strategic shift reflects a growing confidence in the US economy and a desire to tap into its vast potential. Mizuho has made significant investments in its US operations, establishing offices in key financial centers such as New York, Chicago, and Los Angeles, and recruiting top talent to drive its growth initiatives. Furthermore, the bank has been actively pursuing strategic acquisitions and partnerships to enhance its capabilities and expand its market reach. These efforts have enabled Mizuho to offer a comprehensive suite of financial products and services, positioning it as a strong competitor in the US market.

Investment Banking Prowess

Investment banking is a cornerstone of Mizuho's strategy in the US, with a focus on providing advisory services, underwriting, and trading solutions to corporations and institutions. Mizuho's investment banking division has been actively involved in a wide range of transactions, including mergers and acquisitions, equity offerings, and debt financings. The bank's expertise in cross-border transactions, particularly those involving Japanese companies, has been a key differentiator, allowing it to capture a significant share of the market. Mizuho has also been expanding its capabilities in emerging areas such as sustainable finance and technology, reflecting its commitment to innovation and its responsiveness to evolving client needs. The bank's investment banking professionals work closely with clients to understand their strategic objectives and provide tailored solutions to help them achieve their goals. Mizuho's commitment to long-term relationships and its deep understanding of the US market have earned it a reputation as a trusted advisor to its clients.

Commercial Banking Solutions

Mizuho's commercial banking operations in the US provide a range of financial services to businesses of all sizes, from small and medium-sized enterprises (SMEs) to large corporations. These services include lending, cash management, trade finance, and foreign exchange solutions. Mizuho's commercial banking team works closely with clients to understand their specific needs and develop customized solutions to help them manage their finances and grow their businesses. The bank's strong capital base and its global network enable it to provide competitive financing options and facilitate international trade. Mizuho has also been investing in technology to enhance its commercial banking platform, making it easier for clients to access its services and manage their accounts. The bank's commitment to serving the needs of the US business community has made it a valuable partner to companies across a wide range of industries.

Wealth Management Services

Recognizing the growing demand for wealth management services in the US, Mizuho has been expanding its offerings in this area. The bank provides a range of investment management, financial planning, and trust services to high-net-worth individuals and families. Mizuho's wealth management professionals work closely with clients to understand their financial goals and develop personalized investment strategies to help them achieve those goals. The bank's access to global investment opportunities and its expertise in asset allocation enable it to provide sophisticated solutions to its clients. Mizuho has also been investing in technology to enhance its wealth management platform, making it easier for clients to monitor their investments and communicate with their advisors. The bank's commitment to providing personalized service and its focus on long-term relationships have made it a trusted partner to its wealth management clients.

Navigating the Regulatory Landscape

Operating in the US financial market requires a deep understanding of the complex regulatory landscape. Mizuho has invested heavily in compliance and risk management to ensure that it meets all applicable regulations and maintains the highest ethical standards. The bank works closely with regulators to stay abreast of changes in the regulatory environment and to ensure that its operations are in full compliance. Mizuho's commitment to compliance is essential to maintaining its reputation and building trust with its clients. The bank has established a robust compliance program that includes policies, procedures, and training programs to ensure that all employees understand their responsibilities. Mizuho's commitment to regulatory compliance is a key factor in its success in the US market.

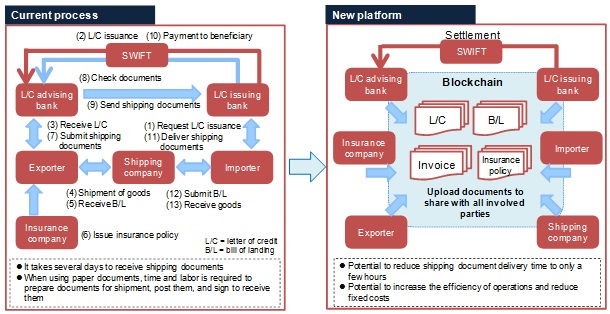

Embracing Technological Innovation

Mizuho recognizes the importance of technology in driving innovation and enhancing its competitiveness. The bank has been investing in a range of technologies, including artificial intelligence, blockchain, and cloud computing, to improve its operations and enhance its customer experience. Mizuho is using AI to automate tasks, improve risk management, and personalize its services. The bank is exploring the use of blockchain to improve the efficiency and security of its transactions. Mizuho is also migrating its applications to the cloud to improve scalability and reduce costs. The bank's commitment to technological innovation is essential to its long-term success in the US market.

Challenges and Opportunities

While Mizuho's expansion in the US market presents significant opportunities, it also faces a number of challenges. These challenges include intense competition from established US banks, navigating the complex regulatory environment, and managing the risks associated with operating in a global market. However, Mizuho is well-positioned to overcome these challenges and capitalize on the opportunities in the US market. The bank's strong capital base, its global network, and its commitment to innovation give it a competitive advantage. Mizuho's focus on building long-term relationships with its clients and its deep understanding of the US market will also be key to its success.

Sustainability and ESG Initiatives

Mizuho is increasingly integrating sustainability and Environmental, Social, and Governance (ESG) factors into its business strategy. The bank is committed to supporting the transition to a low-carbon economy and promoting sustainable development. Mizuho has set ambitious targets for reducing its own carbon footprint and for financing sustainable projects. The bank is also working with its clients to help them improve their ESG performance. Mizuho's commitment to sustainability is not only good for the environment and society, but it is also good for business. Investors are increasingly demanding that companies demonstrate a commitment to ESG, and Mizuho's efforts in this area will help it attract capital and enhance its reputation.

The Future of Mizuho in the US

Mizuho's long-term vision for the US market is one of continued growth and expansion. The bank plans to continue investing in its US operations, expanding its product offerings, and building its client base. Mizuho is also committed to attracting and retaining top talent, and to fostering a culture of innovation and collaboration. The bank believes that its commitment to the US market will enable it to achieve its strategic objectives and solidify its position as a leading global financial institution. Mizuho's future success in the US will depend on its ability to adapt to changing market conditions, to innovate its products and services, and to maintain its commitment to its clients and its employees. The bank's strategic focus on investment banking, commercial banking, and wealth management, coupled with its commitment to sustainability and technological innovation, positions it well for continued success in the US market.

No comments:

Post a Comment