Silicon Motion (SIMO) has recently garnered attention, prompting investors to consider factors influencing its near-term stock performance. While the stock has shown a modest gain of 4% over the past month, it slightly trails the S&P 500 composite's 4.5% increase. Furthermore, it significantly lags behind the broader Computer - Integrated Systems industry's impressive 12.5% growth during the same period. This raises the crucial question: where is Silicon Motion headed in the near future?

The Power of Earnings Estimate Revisions

While fleeting news or rumors can cause short-term price fluctuations, fundamental factors ultimately dictate long-term investment decisions. A primary focus should be placed on a company's earnings projections. The rationale is that a stock's fair value reflects the present value of its anticipated future earnings stream.

The direction of earnings estimate revisions by analysts offers valuable insight into a company's prospects. Upward revisions typically signal an increase in the stock's fair value. This attracts investors, driving demand and pushing the price higher. Empirical evidence supports a strong correlation between trends in earnings estimate revisions and near-term stock price movements.

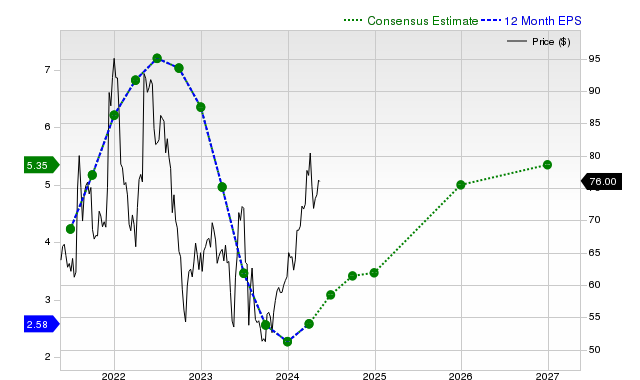

For the current quarter, Silicon Motion is projected to report earnings of $0.52 per share, representing a 45.8% year-over-year decline. However, the consensus estimate has remained stable over the last 30 days. Looking at the current fiscal year, the consensus earnings estimate stands at $3.41, a slight decrease of 0.6% from the previous year. Notably, this estimate has seen a marginal increase of 0.2% over the past month.

The outlook for the next fiscal year is more optimistic, with a consensus earnings estimate of $4.56, reflecting a substantial 33.6% increase from the expected performance of the current year. This estimate has remained unchanged over the past month.

Zacks Rank: A Leading Indicator

The Zacks Rank, a proprietary stock rating system, provides a data-driven assessment of a stock's near-term price performance. By leveraging the power of earnings estimate revisions and considering other related factors, the Zacks Rank offers a more conclusive indicator. Silicon Motion currently holds a Zacks Rank #2 (Buy), suggesting potential outperformance in the near term.

Revenue Growth: The Engine of Progress

While earnings growth is a key indicator of financial health, revenue growth is equally crucial. Sustainable earnings growth hinges on a company's ability to expand its revenues over time. Therefore, assessing a company's revenue growth potential is essential.

For Silicon Motion, the consensus sales estimate for the current quarter is $180.4 million, representing a 14.4% year-over-year decrease. However, the estimates for the current and next fiscal years paint a more positive picture, with projections of $815.03 million and $921.58 million, respectively, indicating growth of 1.4% and 13.1%.

Past Performance and Surprises

In the last reported quarter, Silicon Motion posted revenues of $166.49 million, a 12.1% year-over-year decline. Earnings per share (EPS) for the same period were $0.6, compared to $0.64 in the previous year.

However, the reported revenues exceeded the consensus estimate of $162.58 million by 2.41%. The EPS also surpassed expectations, with a positive surprise of 39.53%.

Notably, Silicon Motion has consistently beaten consensus EPS estimates in each of the past four quarters. Furthermore, the company has exceeded consensus revenue estimates in three out of the last four quarters.

Valuation Assessment

A thorough investment decision requires a careful evaluation of a stock's valuation. Determining whether a stock's current price accurately reflects the underlying business's intrinsic value and growth prospects is essential for predicting future price performance.

Comparing a company's valuation multiples, such as price-to-earnings (P/E), price-to-sales (P/S), and price-to-cash flow (P/CF), to its historical values can help assess whether the stock is fairly valued, overvalued, or undervalued. Additionally, comparing the company to its peers on these metrics provides valuable context for the stock's price.

The Zacks Value Style Score, which considers both traditional and unconventional valuation metrics, assigns a grade from A to F to stocks, indicating their relative valuation. Silicon Motion currently holds a grade of D, suggesting that it may be trading at a premium compared to its peers.

Conclusion

Analyzing these various factors can inform investment decisions regarding Silicon Motion. The company's Zacks Rank #2 (Buy) suggests potential near-term outperformance relative to the broader market, but a comprehensive understanding of its earnings estimates, revenue growth, past performance, and valuation is crucial for making informed investment choices.

No comments:

Post a Comment