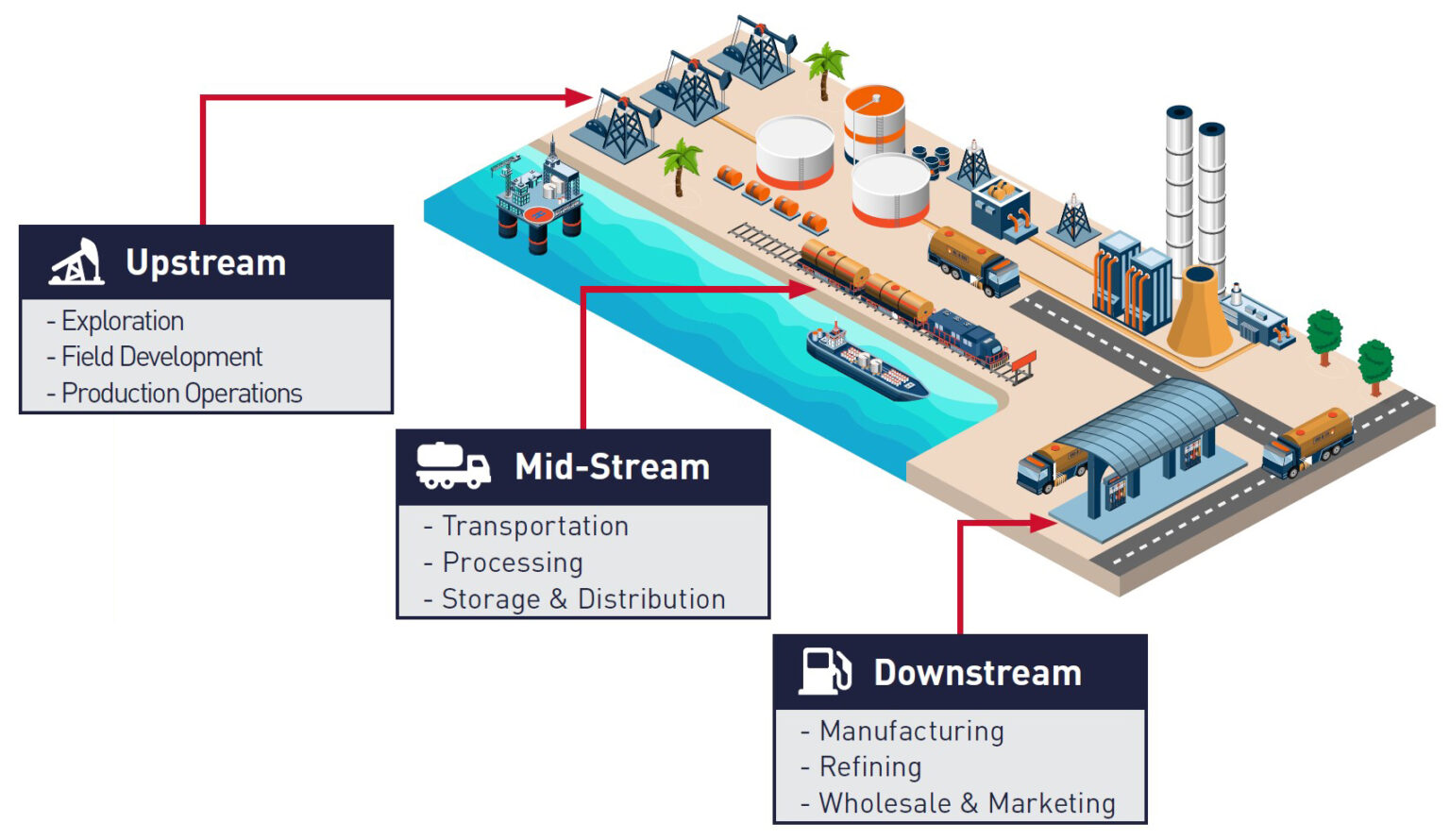

Canada stands as the fourth-largest oil-producing nation globally, boasting a dynamic oil and gas industry that significantly contributes to its economy. This sector is broadly categorized into three segments: upstream, midstream, and downstream. Upstream companies are involved in the exploration and production of crude oil and natural gas, while midstream entities handle the storage and transportation of these resources. Downstream companies focus on refining and selling finished petroleum products. This article delves into the leading Canadian oil and gas companies, examining their operations, financial performance, and key contributions to the industry.

Understanding the Canadian Oil and Gas Landscape

The Canadian oil and gas industry is a multifaceted sector with companies specializing in various aspects of the supply chain. Upstream activities involve exploration, drilling, and extraction of crude oil and natural gas. A notable example of upstream operations is the extraction of crude bitumen from the Canadian oil sands. This process involves either mining the bitumen or using in-situ methods, which inject steam and chemicals to separate the bitumen from the sand. These methods are often more costly compared to traditional well-extraction techniques.

Midstream operations encompass the storage and transportation of oil and gas through pipelines, tankers, and other infrastructure. Downstream operations involve refining crude oil into various petroleum products, such as gasoline, diesel, and jet fuel, and distributing these products to consumers and businesses. Integrated companies, like Suncor Energy and Imperial Oil, participate in multiple segments of the industry, allowing them to manage costs and optimize their operations across the entire value chain. The performance of these companies is closely tied to global oil prices and economic conditions, making them susceptible to market fluctuations.

Top 10 Canadian Oil and Gas Companies by Revenue

As of August 29, 2024, the following are the top 10 Canadian oil and gas companies based on their trailing 12 months (TTM) revenue:

- Cenovus Energy: CA$55.99 billion

- Suncor Energy: CA$50.73 billion

- Imperial Oil: CA$49.96 billion

- Enbridge Inc.: CA$43.44 billion

- Canadian Natural Resources: CA$36.74 billion

- Parkland Corporation: CA$30.92 billion

- TC Energy Corp: CA$15.67 billion

- Gibson Energy: CA$12.56 billion

- Pembina Pipeline Corporation: CA$8.18 billion

- ARC Resources Ltd.: CA$5.25 billion

These companies represent a significant portion of Canada's oil and gas production and contribute substantially to the country's economy through employment, investment, and tax revenues. Each company has its unique strengths and strategic focus, playing a vital role in the overall energy landscape.

Cenovus Energy: The Revenue Leader

Cenovus Energy, established in 2009 and headquartered in Calgary, Alberta, leads the Canadian oil and gas industry with a TTM revenue of CA$55.99 billion. As an integrated oil and natural gas company, Cenovus is involved in developing, producing, and marketing crude oil, natural gas liquids, and natural gas across Canada, the United States, and the Asia Pacific region. The company also refines crude oil and transports and sells refined petroleum and chemical products. Cenovus Energy's diversified operations and strategic geographic presence contribute to its robust financial performance. Despite a 1-Year Total Return of -3.62%, the company's net income stands at CA$4.78 billion, with a market capitalization of CA$47.44 billion. Cenovus Energy continues to invest in innovation and sustainable practices to enhance its operational efficiency and environmental stewardship.

Suncor Energy: A Focus on Oil Sands Development

Suncor Energy Inc., founded in 1917 and also based in Calgary, Alberta, ranks second with a TTM revenue of CA$50.73 billion. Suncor is an integrated energy company with a primary focus on developing petroleum resource basins in Canada's Athabasca oil sands. The company's activities span exploration, acquisition, development, production, refining, transportation, and marketing of crude oil. Suncor Energy is known for its pioneering work in oil sands technology and its commitment to responsible resource development. With a net income of CA$7.54 billion and a market capitalization of CA$70.19 billion, Suncor boasts a 1-Year Total Return of 19.66%, reflecting its strong financial health and investor confidence. Suncor Energy's strategic investments in renewable energy and carbon reduction technologies underscore its commitment to a sustainable energy future.

Imperial Oil: A Subsidiary of ExxonMobil

Imperial Oil, incorporated in 1880 and headquartered in Calgary, Alberta, secures the third position with a TTM revenue of CA$49.96 billion. As an integrated company and a subsidiary of ExxonMobil, Imperial Oil is involved in the exploration, production, refining, transportation, and sale of crude oil and natural gas products. The company's extensive distribution system utilizes tankers, trucks, rail, and pipelines to move petroleum products to market. Imperial Oil also manufactures and markets a variety of petrochemicals. With a net income of CA$5.29 billion and a market capitalization of CA$54.60 billion, Imperial Oil exhibits a solid 1-Year Total Return of 33.82%. Imperial Oil leverages ExxonMobil's global expertise and resources to maintain its competitive edge and drive innovation in the Canadian market.

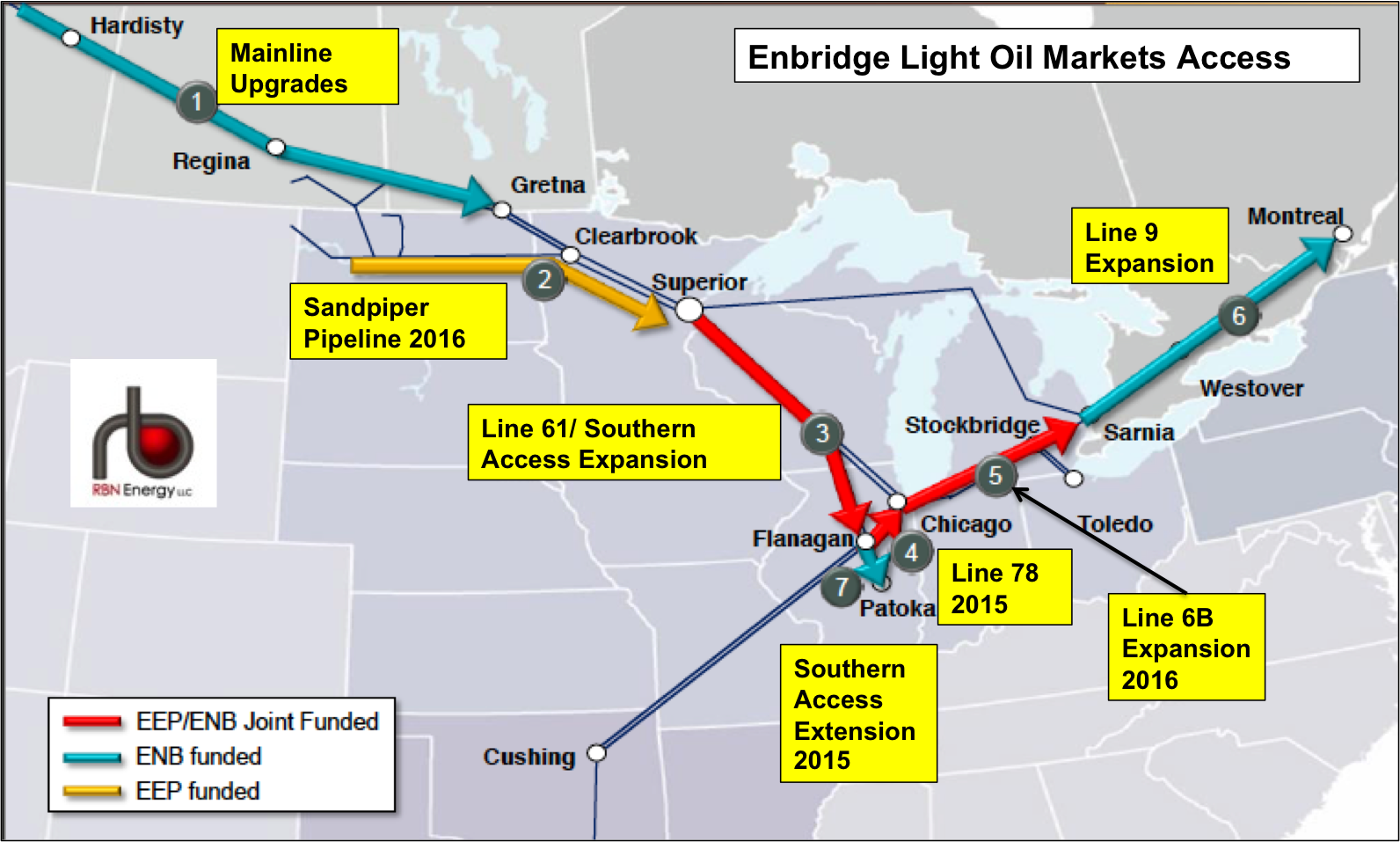

Enbridge Inc.: A Leader in Energy Infrastructure

Enbridge Inc., established in 1949 and headquartered in Calgary, Alberta, stands out as a leading energy infrastructure company with a TTM revenue of CA$43.44 billion. Enbridge provides energy transportation, distribution, and related services through its extensive network of crude oil, liquids, and natural gas pipelines. The company also operates regulated natural gas distribution utilities and invests in renewable energy assets and transmission facilities. Enbridge's diverse portfolio and strategic investments in infrastructure make it a critical player in the North American energy market. With a net income of CA$5.89 billion and a market capitalization of CA$116.19 billion, Enbridge demonstrates a 1-Year Total Return of 11.75%, underscoring its stability and growth potential.

Canadian Natural Resources: Exploration and Production Expertise

Canadian Natural Resources, incorporated in 1973 and based in Calgary, Alberta, is a prominent oil and gas exploration and production company with a TTM revenue of CA$36.74 billion. The company produces synthetic crude oil, light and medium crude oil, bitumen, primary heavy crude oil, and Pelican Lake heavy crude oil. Canadian Natural Resources also markets and sells its crude oil, natural gas, and natural gas liquids. The company's focus on operational efficiency and technological innovation enables it to maintain a strong competitive position. With a net income of CA$7.67 billion and a market capitalization of CA$104.47 billion, Canadian Natural Resources achieves a 1-Year Total Return of 14.08%, reflecting its commitment to shareholder value.

Parkland Corporation: Marketing and Distribution of Petroleum Products

Parkland Corporation, formerly known as Parkland Fuel Corp., was established in 1977 and is headquartered in Calgary, Alberta. It is an energy supplier engaged in the marketing and distribution of a variety of petroleum products including gasoline, diesel, propane, lubricants, heating oil, and more. Parkland supplies and supports a network of retail gas stations, and offers its products to a range of commercial, industrial, and residential customers. Its supply segment manufactures transportation fuels. It also transports, stores, and sells fuels, crude oil, and liquid petroleum gases. In addition, the Supply segment manufactures and sells aviation fuel to airlines. With a TTM revenue of CA$30.92 billion, Parkland is a key player in the downstream segment. However, its net income is CA$381 million, with a market cap of CA$6.28 billion and a 1-Year Total Return of -2.28%.

TC Energy Corp: Energy Infrastructure and Pipeline Operations

TC Energy Corp, incorporated in 1951 and headquartered in Calgary, Alberta, is an energy infrastructure company that builds and operates a network of natural gas pipelines, which transport natural gas from supply basins to local distribution companies, power generation plants, industrial facilities, and other customers. The company also owns regulated natural gas storage facilities and power generation facilities. With a TTM revenue of CA$15.67 billion, TC Energy is a vital part of North America's energy transport network. Its net income is CA$3.53 billion, with a market cap of CA$63.98 billion and a 1-Year Total Return of 25.75%.

Gibson Energy: Integrated Service Provider

Gibson Energy was established in 1950 and is headquartered in Calgary, Canada. It is an integrated service provider to the oil and gas industry. The company engages in the transportation, storage, blending, processing, marketing, and distribution of crude oil, condensate, natural gas liquids, water, oilfield waste, and refined products. The company owns a network of terminals, pipelines, and storage tanks. With a TTM revenue of CA$12.56 billion, Gibson Energy plays a critical role in the midstream sector. Its net income is CA$177.75 million, with a market cap of CA$3.58 billion and a 1-Year Total Return of 9.23%.

Pembina Pipeline Corporation: Transportation and Midstream Services

Pembina Pipeline Corporation was incorporated in 1954 and is headquartered in Calgary, Canada. It provides transportation and midstream services for the energy industry. The company operates conventional and oil-sands pipelines, stores oil, and gathers and processes natural gas. It provides infrastructure for natural gas, condensate, and natural gas liquids (NGLs), cavern storage, as well as related pipeline and rail terminal facilities. With a TTM revenue of CA$8.18 billion, Pembina is a key player in the transportation of energy resources. Its net income is CA$1.95 billion, with a market cap of CA$31.32 billion and a 1-Year Total Return of 28.34%.

ARC Resources Ltd.: Exploration and Production in Western Canada

Established in 1996, ARC Resources Ltd. is headquartered in Calgary, Canada. It operates in Alberta and northeast British Columbia. The company explores, develops, manufactures, and transports crude oil, natural gas, and natural gas liquids. ARC targets residential, commercial, and industrial energy usage. It prides itself on low-cost, low-emissions energy. With a TTM revenue of CA$5.25 billion, ARC Resources focuses on efficient and environmentally conscious energy production. Its net income is CA$1.17 billion, with a market cap of CA$14.96 billion and a 1-Year Total Return of 21.73%.

Investment Potential in Canadian Oil Stocks

Bob Ciura's analysis from August 22nd, 2025, highlights the investment potential of Canadian oil stocks, particularly for income investors. Canadian oil stocks often offer higher dividend payouts compared to their U.S. counterparts, making them an attractive option for those seeking steady income. Furthermore, valuations of these stocks have remained relatively low, potentially boosting their total return profiles. The top 9 Canadian oil stocks, ranked based on total expected returns over the next five years, offer a diverse range of investment opportunities. However, U.S. investors should be aware of the 15% dividend withholding tax imposed by Canada, although this can often be waived when investing through a U.S. retirement account.

The Sure Analysis Research Database provides comprehensive insights into these stocks, ranking them based on dividend yield, earnings-per-share growth potential, and changes in valuation multiples. Here's a brief overview of the top 9 Canadian oil stocks, ranked from lowest to highest expected annual returns over the next five years:

- Imperial Oil (IMO): -6.9%

- Tamarack Valley Energy (TNEYF): -6.7%

- Paramount Resources (PRMRF): -3.6%

- Whitecap Resources (WCPRF): -0.2%

- Suncor Energy (SU): 2.7%

- Canadian Natural Resources (CNQ): 5.0%

- Freehold Royalties Ltd. (FRHLF): 6.0%

- Enbridge Inc. (ENB): 6.6%

- InPlay Oil Corp. (IPOOF): 6.9%

Navigating the Future of Canadian Oil and Gas

The Canadian oil and gas industry faces a complex landscape, balancing the need for energy production with increasing environmental concerns and the global transition to renewable energy sources. Companies are investing in technologies to reduce emissions, improve efficiency, and develop cleaner energy solutions. The future of the industry will likely involve a combination of traditional oil and gas production, coupled with investments in renewable energy and carbon capture technologies. As the world continues to demand energy, Canadian oil and gas companies will need to adapt and innovate to remain competitive and sustainable. The top companies mentioned in this article are at the forefront of these efforts, driving innovation and shaping the future of the Canadian energy sector.

No comments:

Post a Comment